Get inside Wall Street with StreetInsider Premium. Claim your 1-week free trial here.

UNITEDSTATES

SECURITIESAND EXCHANGE COMMISSION

Washington,D.C. 20549

SCHEDULE14A

ProxyStatement Pursuant to Section 14(a) ofthe Securities Exchange Act of 1934 (Amendment No. _)

| Filedby the Registrant ☒Filedby a Party other than the Registrant ☐ | ||

| Checkthe appropriate box: | ||

| ☐ | PreliminaryProxy Statement | |

| ☐ | Confidential,for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | DefinitiveProxy Statement | |

| ☐ | DefinitiveAdditional Materials | |

| ☐ | SolicitingMaterial under §240.14a-12 | |

| NUZEE,INC. | ||

| (Nameof Registrant as Specified In Its Charter) | ||

| Nameof Person(s) Filing Proxy Statement, if other than the Registrant | ||

| Paymentof Filing Fee (Check the appropriate box): | ||

| ☒ | Nofee required. | |

| ☐ | Feecomputed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Titleof each class of securities to which transaction applies: | |

| (2) | Aggregatenumber of securities to which transaction applies: | |

| (3) | Perunit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: | |

| (4) | Proposedmaximum aggregate value of transaction: | |

| (5) | Totalfee paid: | |

| ☐ | Feepaid previously with preliminary materials. | |

| ☐ | Checkbox if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsettingfee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of itsfiling. | |

| (1) | AmountPreviously Paid: | |

| (2) | Form,Schedule or Registration Statement No.: | |

| (3) | FilingParty: | |

| (4) | DateFiled: | |

NUZEE,INC.

NOTICEOF THE ANNUAL MEETING OF STOCKHOLDERS

TOBE HELD ON MARCH 17, 2022

Tothe Stockholders of NuZee, Inc.:

Youare cordially invited to virtually attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of NuZee, Inc.,a Nevada corporation (the “Company”), to be held virtually, via live webcast at www.virtualshareholdermeeting.com/NUZE2022,on March 17, 2022 at 5:00 p.m., Eastern Time, in order to:

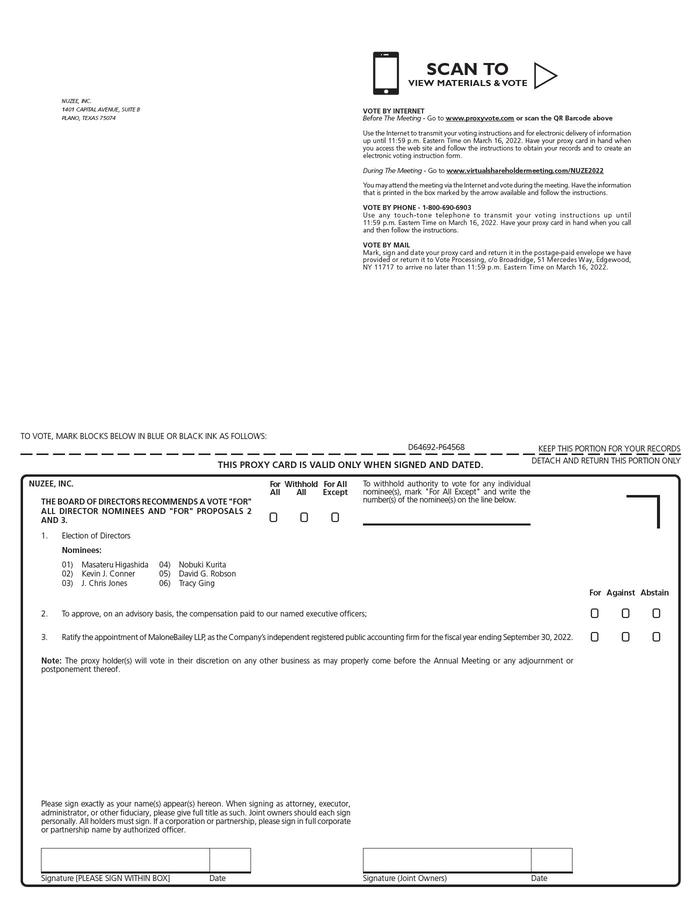

| 1. | Electsix directors for a term of one year or until their respective successors have been duly elected and qualified; | |

| 2. | Holda non-binding advisory vote on the compensation paid to our named executive officers; | |

| 3. | Ratifythe appointment of MaloneBailey LLP, as the Company’s independent registered public accounting firm for the fiscal year endingSeptember 30, 2022; and | |

| 4. | Transactsuch other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Theboard of directors of the Company (the “Board”) has fixed the close of business on January 19, 2022 as the record date fordetermining the stockholders of the Company entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponementsthereof. Please review in detail the proxy statement for a more complete statement of matters to be considered at the Annual Meeting.

TheAnnual Meeting will be held entirely online in a virtual meeting format only, with no physical in-person meeting, to allow greater participation.Stockholders attending the Annual Meeting virtually will be afforded the same rights and opportunities to participate as they would atan in-person meeting. We encourage you to attend online and participate in the Annual Meeting, where you will be able to listen to themeeting live, submit questions and vote. Stockholders may participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/NUZE2022.To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions thataccompanied your proxy materials. We recommend that you log in a few minutes before the Annual Meeting to ensure you are logged in whenthe Annual Meeting starts.

Yourvote is very important to us regardless of the number of shares you own. Whether or not you are able to virtually attend the Annual Meeting,please read the proxy statement and promptly vote your proxy via the internet, by telephone or, if you received a printed form of proxyin the mail, by completing, dating, signing and returning the enclosed proxy card in order to assure representation of your shares atthe Annual Meeting. Granting a proxy will not limit your right to vote if you wish to virtually attend the Annual Meeting and vote onlineduring the Annual Meeting.

| Byorder of the Board of Directors, | |

| /s/Patrick Shearer | |

| PatrickShearer | |

| ChiefFinancial Officer |

Plano,Texas

January27, 2022

Youare cordially invited to virtually attend the Annual Meeting. Whether or not you expect tovirtually attend the Annual Meeting, PLEASE VOTE YOUR SHARES IN ADVANCE. You may vote yourshares in advance of the Annual Meeting via the internet, by telephone or, by mailing thecompleted proxy card. Voting instructions are printed on your proxy card. Ifyou were a stockholder of record as of January 19, 2022, you may vote online during the Annual Meeting. If, on January 19, 2022,your shares of our common stock were held, not in your name, but rather in an account at a brokerage firm, bank or other similarorganization, you are also invited to attend the Annual Meeting and may vote online during the Annual Meeting. However, even if youplan to attend the Annual Meeting, the Company recommends that you vote your shares in advance, so that your vote will be countedif you later decide not to attend the Annual Meeting. IMPORTANTNOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MARCH 17, 2022

Ourproxy statement for the Annual Meeting, proxy card and our Annual Report on Form 10-K for the fiscal year ended September 30, 2021are also available free of charge at www.proxyvote.com.

|

NuZee,Inc.

2022Annual Meeting of Stockholders

PROXYSTATEMENT

Thisproxy statement and the accompanying form of proxy are being furnished to the stockholders of NuZee, Inc., a Nevada corporation (the“Company”, “we”, “us”, or “our”), on or about January 27, 2022, in connection with thesolicitation of proxies by the Company’s Board of Directors (the “Board”) for use at the 2022 Annual Meeting of Stockholders(the “Annual Meeting”) to be held virtually, via live webcast at www.virtualshareholdermeeting.com/NUZE2022, on Thursday,March 17, 2022 at 5:00 p.m., Eastern Time, and any adjournment or postponements thereof.

TheAnnual Meeting will be held entirely online to allow greater participation. Stockholders may participate in the Annual Meeting by visitingthe following website: www.virtualshareholdermeeting.com/NUZE2022. To participate in the Annual Meeting, you will need the 16-digitcontrol number included on your proxy card or on the instructions that accompanied your proxy materials.

Thecost of soliciting proxies will be borne by the Company. Following the mailing of this proxy statement, the Company may conduct furthersolicitations personally, telephonically or by facsimile through its officers, directors and employees, none of whom will receive additionalcompensation for assisting with any such solicitations. The Company does not intend to retain a proxy solicitor in connection with theAnnual Meeting. Brokerage houses, nominees, custodians and fiduciaries will be requested to forward soliciting material to beneficialowners of stock held of record by them, and the Company, upon request, will reimburse such persons for their reasonable out-of-pocketexpenses in doing so.

Onlyholders of record of outstanding shares of the Company’s common stock, par value $0.00001 per share (“Common Stock”),at the close of business on January 19, 2022 (the “record date”), are entitled to notice of, and to vote at, the Annual Meetingor any adjournment or postponements thereof. Each holder of Common Stock is entitled to one vote for each share of Common Stock heldon the record date. There were 18,204,837 shares of Common Stock outstanding and entitled to vote on January 19, 2022. If you plan toattend the Annual Meeting online, please see the instructions below.

Howdo I attend, participate in, and ask questions during the virtual Annual Meeting?

TheCompany will be hosting the Annual Meeting via live webcast only. All stockholders as of the record date may attend the Annual Meetinglive online at www.virtualshareholdermeeting.com/NUZE2022. The Annual Meeting will start at 5:00 p.m., Eastern Time, on Thursday,March 17, 2022. Stockholders attending the Annual Meeting virtually will be afforded the same rights and opportunities to participateas they would at an in-person meeting.

Inorder to enter the Annual Meeting, you will need the control number, which is included on your proxy card if you are a stockholder ofrecord, or included with your voting instruction card and voting instructions received from your broker, bank or other agent if you holdyour shares in “street name.” Instructions on how to attend and participate online are available at www.virtualshareholdermeeting.com/NUZE2022.We recommend that you log in a few minutes before the scheduled start time to ensure you are logged in when the Annual Meeting starts.The webcast will open 15 minutes before the start of the Annual Meeting.

| 1 |

Tohelp ensure that we have a productive and efficient meeting, and in fairness to all stockholders in attendance, you will also find postedour rules of conduct for the Annual Meeting when you log in prior to its start. These rules of conduct will include the following guidelines:

| ● | Youmay submit questions and comments electronically through the meeting portal during the Annual Meeting. If you wish to submit a questionduring the Annual Meeting, you may do so by logging in to the virtual meeting platform at www.virtualshareholdermeeting.com/NUZE2022and typing your question into the “Ask a Question” field, and clicking “Submit”. | |

| ● | Onlystockholders as of the record date for the Annual Meeting and their proxy holders may submit questions at the Annual Meeting. | |

| ● | Pleasedirect all questions to the Secretary of the Company. | |

| ● | Pleaseinclude your name and affiliation, if any, when submitting a question or comment. | |

| ● | Limityour remarks to one brief question or comment that is relevant to the Annual Meeting and/or our business. | |

| ● | Questionsmay be grouped by topic by our management. | |

| ● | Questionsmay also be ruled as out of order if they are, among other things, irrelevant to our business, related to pending or threatened litigation,disorderly, repetitious of statements already made, or in furtherance of the speaker’s own personal, political or businessinterests. | |

| ● | Berespectful of your fellow stockholders and Annual Meeting participants. | |

| ● | Noaudio or video recordings of the Annual Meeting are permitted. |

Ifyou encounter any difficulties accessing the virtual Annual Meeting during login or in the course of the meeting, please contact thephone number found on the login page at www.virtualshareholdermeeting.com/NUZE2022.

Whocan vote at the Annual Meeting?

Onlystockholders of our Common Stock at the close of business on the record date will be entitled to vote at the Annual Meeting. On the recorddate, there were 18,204,837 shares of Common Stock outstanding and entitled to vote.

Stockholderof Record: Shares Registered in Your Name

If,on the record date, your shares of Common Stock were registered directly in your name with our transfer agent, V Stock Transfer, LLC,then you are a stockholder of record. As a stockholder of record, you may vote (i) through the internet before or at the Annual Meeting,using the instructions on the proxy card and those posted at www.virtualshareholdermeeting.com/NUZE2022; (ii) by telephone fromthe United States, using the number on the proxy card; or (iii) by completing and returning the enclosed printed proxy card. Whetheror not you plan to virtually attend the Annual Meeting, we urge you to vote your shares by proxy in advance of the Annual Meeting electronicallythrough the internet, by telephone or by completing and returning the enclosed printed proxy card. To help us keep our costs low inthese extraordinary times, please vote through the internet, if possible.

BeneficialOwner: Shares Registered in the Name of a Broker or Bank

If,on the record date, your shares of Common Stock were held, not in your name, but rather in an account at a brokerage firm, bank or othersimilar organization, then you are the beneficial owner of shares held in “street name”. The organization holding your accountis considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the rightto direct your broker (or bank or other nominee) regarding how to vote the shares in your account. You may so instruct your broker (orbank or other nominee) through the internet or by telephone as described in the applicable instructions your broker has provided withthese proxy materials. You may also vote by completing the voting instruction card your broker provides to you. To help us keep ourcosts low in these extraordinary times, please vote through the internet, if possible. As a beneficial owner, you are also invitedto virtually attend the Annual Meeting at www.virtualshareholdermeeting.com/NUZE2022 by entering the 16-digit control number providedby your broker (or bank or other nominee) and vote your shares of Common Stock online during the Annual Meeting.

CanI revoke my proxy and change my vote?

Anystockholder of record who executes and delivers a proxy may revoke it at any time prior to its use by (i) giving written notice of revocationto the Secretary of the Company, (ii) executing and delivering a proxy bearing a later date, or (iii) virtually attending the AnnualMeeting and voting online during the Annual Meeting. Simply attending the Annual Meeting will not, by itself, revoke your proxy. Evenif you plan to virtually attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions in advance ofthe Annual Meeting so that your vote will be counted if you later decide not to virtually attend the Annual Meeting.

| 2 |

Ifyou are a beneficial owner, you will need to revoke or resubmit your proxy through your broker (or bank or other nominee) and in accordancewith its procedures.

Whatare the recommendations of the Board?

Eachof the recommendations of the Board is set forth together with the description of each item in this proxy statement. In summary, theBoard recommends a vote “FOR” the election of the nominees to the Board as more fully described in the section herein titled“Proposal 1;” and the Board recommends a vote “FOR” each of Proposals 2 and 3. If you sign and return your proxycard but do not specify how you want your shares voted, the persons named as proxy holders on the proxy card will vote in accordancewith the recommendations of the Board.

TheBoard does not know of any other matters that may be brought before the Annual Meeting nor does it foresee or have reason to believethat the proxy holders will have to vote for a substitute or alternate board nominee for director. In the event that any other mattershould properly come before the Annual Meeting or any nominee for director is not available for election, the proxy holders will voteas recommended by the Board or, if no recommendation is given, in accordance with their best judgment.

Whatconstitutes a quorum?

Thepresence, by virtual attendance or by proxy, of the holders of shares of Common Stock entitled to vote at the Annual Meeting representinga majority of the outstanding votes entitled to be cast is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker“non-votes” will be counted as present in determining whether the quorum requirement is satisfied. For information on broker“non-votes”, see below under “What are the effects of broker non-votes?”

Whatvote is required to approve each item?

ProposalOne — Election of directors. Assuming that a quorum is present, the affirmative votes equal to at least a majority of the votesof Common Stock entitled to vote and present by virtual attendance or represented by proxy at the Annual Meeting are required for theelection of directors. Stockholders do not have the right to cumulate their votes for directors.

ProposalTwo — Non-binding advisory vote on compensation paid to our named executive officers. The affirmative votes equal to at leasta majority of the votes of Common Stock entitled to vote and present by virtual attendance or represented by proxy at the Annual Meetingwill be required for approval of the advisory vote of the compensation of our named executive officers. Because this vote is advisory,it will not be binding upon the Board. However, the Board and its compensation committee (the “Compensation Committee”) willtake into account the outcome of the vote when considering future executive compensation arrangements.

ProposalThree — Ratification of the appointment of the Independent Registered Public Accounting Firm. The affirmative votes equal toat least a majority of the votes of Common Stock entitled to vote and present by virtual attendance or represented by proxy at the AnnualMeeting will be required for approval of the ratification of the appointment of MaloneBailey LLP as our independent registered publicaccounting firm for the fiscal year ending September 30, 2022.

OtherMatters. For each other matter, the proposal will be approved if affirmative votes equal to at least a majority of the votes of CommonStock entitled to vote and present by virtual attendance or represented by proxy at the Annual Meeting are cast in favor of the action.

| 3 |

Whatare the effects of broker non-votes?

Abroker “non-vote” generally occurs when a broker or other nominee holding shares for a beneficial owner does not vote ona proposal because the broker or other nominee has not received instructions as to such proposal from the beneficial owner and does nothave discretionary powers as to such proposal. If you are a beneficial owner and do not provide your broker or other nominee with instructionson how to vote your street name shares, your broker or nominee will not be permitted to vote them on “non-routine” matters(a broker non-vote).

TheCompany believes Proposals One and Two are considered non-routine matters under applicable rules. Please note that brokers may not voteyour shares on Proposals One and Two in the absence of your specific instructions as to how to vote. If you hold shares in street name,it is therefore particularly important that you instruct your brokers on how you wish to vote your shares so that your vote can be counted.We encourage you to provide instructions to your broker regarding the voting of your shares.

Sharessubject to a broker non-vote will not be considered entitled to vote with respect to Proposals One and Two and will not affect theiroutcome.

Theratification of the appointment of MaloneBailey LLP as our independent registered public accounting firm for the fiscal year ending September30, 2022 (Proposal Three) is considered a routine matter under applicable rules. A broker or other nominee may generally vote on routinematters, and therefore no broker non-votes are expected to exist in connection with Proposal Three.

Howare abstentions treated?

Abstentionswill have the effect of votes against all the Proposals.

| 4 |

PROPOSAL1 – ELECTION OF DIRECTORS

Directorsand Nominees

TheArticles of Incorporation, as amended (the “Articles”), of the Company provide that the Board shall consist of at least oneand no more than thirteen directors, comprising only one class of directors, with the exact number being designated from time to timeby resolution of the Board. Our Board is elected annually by our stockholders, and each director is elected for a term of one year oruntil his or her successor has been duly elected and qualified. Our nominees for election include our five current independent directorsand the person who serves as our Chairman and Chief Executive Officer. Proxies cannot be voted for a greater number of persons than thenumber of nominees named in this proxy statement.

Thenumber of members of our Board is currently six (6). The Board has nominated Masateru Higashida, Kevin J. Conner, Tracy Ging, J. ChrisJones, Nobuki Kurita, and David G. Robson, each of whom currently serve on the Board, to stand for re-election as directors at the AnnualMeeting. If Ms. Ging and Messrs. Higashida, Conner, Jones, Kurita and Robson are elected, they will each serve a term expiring at theannual meeting of stockholders in 2023, or until their successors are elected and qualified. There are no family relationships amongany of our director nominees or executive officers.

Priorto her appointment to the Board in April 2021, Ms. Ging was initially recommended to the nominating and corporate governance committeeof the Board (the “Nominating and Corporate Governance Committee”) by Mr. Higashida, our Chairman and Chief Executive Officer.The Nominating and Corporate Governance Committee met with Ms. Ging and reviewed her qualifications and subsequently recommended to theBoard that Ms. Ging be appointed to the Board.

TheBoard has no reason to believe that any of its nominees will refuse or be unable to accept election. However, if any nominee is unableto accept election or if any other unforeseen contingencies should arise, the Board may designate a substitute nominee. If the Boarddesignates a substitute nominee, the persons named as proxies will vote for the substitute nominee designated by the Board.

THEBOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE LISTED NOMINEES.

Thefollowing table, together with the accompanying text, sets forth certain information with respect to each of our director nominees:

Nomineesfor Director

| Name | Age | Position | DirectorSince | |||

| MasateruHigashida | 50 | ChiefExecutive Officer, President, Treasurer, Secretary and Chairman of the Board | 2011 | |||

| KevinJ. Conner | 59 | Director | 2019 | |||

| TracyGing | 50 | Director | 2021 | |||

| J.Chris Jones | 66 | Director | 2019 | |||

| NobukiKurita | 66 | Director | 2021 | |||

| DavidG. Robson | 55 | Director | 2021 |

MASATERUHIGASHIDA Mr. Higashida has served as our Chief Executive Officer, Secretary, and Treasurer since October 2014, and as Chair of theBoard since April 2013. In July 2020, Mr. Higashida was also re-appointed President of the Company. He previously also held the positionof President from October 2014 until August 2017, and Chief Financial Officer from August 2014 until February 2019. Mr. Higashida previouslyfounded multiple companies, including a Korea-based investment company and a Singapore-based investment company, and began his careerin the financial industry in Nagoya, Japan.

| 5 |

Mr.Higashida is an employee director. The Board values Mr. Higashida’s extensive experience operating the Company. As the Company’sChief Executive Officer and President, Mr. Higashida is able to apprise the Board of the operational and financial results as they occurand provide insight into the environment in which the Company operates.

KEVINJ. CONNER Mr. Conner has served on our Board since October 2019. Mr. Conner is currently Managing Director of Conner & Associates,a restructuring and turnaround servicing firm he founded in 1991. Mr. Conner has held senior management and board seats of public andprivate companies along with being the Chair of the Conner & Associates’ SEC audit practice. Mr. Conner is frequently retainedas a qualified expert witness in matters before both Federal and State courts, including both corporate governance and general businessmatters. Mr. Conner holds an MS in Taxation from Philadelphia University and a BS in Accounting from West Chester University of Pennsylvaniaalong with being licensed to practice as a CPA in the State of New York and the Commonwealth of Pennsylvania.

Mr.Conner’s qualifications for election to the Board include his expertise in public company accounting and regulatory compliancematters.

TRACYGING Ms. Ging has served on our Board since April 2021. Since June 2020, Ms. Ging has served as Chief Marketing Officer of Kum &Go, a convenience store chain with 400 stores across 11 states. Her responsibilities in this position include providing executive leadershipfor merchandising, business intelligence and analytics, and serving on the senior leadership team responsible for the long-term strategicdirection of the business. Prior to joining Kum & Go, Ms. Ging served as Chief Business Officer of S&D Coffee and Tea from 2012to 2020. Ms. Ging earned a Bachelor of Science from Indiana University and a Master’s Degree in Communication and OrganizationalLeadership from Gonzaga University. In addition, in December 2021, Ms. Ging completed the General Management Program from The WhartonSchool of the University of Pennsylvania, where she focused her studies on digital strategies and board governance.

Ms.Ging’s qualifications for election to the Board include her extensive marketing and leadership experience, coupled with her experiencein the coffee industry, which provides our Board with a valuable perspective on the business sector in which our Company operates.

J.CHRIS JONES Mr. Jones has served on our Board since October 2019. Mr. Jones currently serves as the Managing Director of HaddingtonVentures, LLC, a venture fund manager and advisor Mr. Jones co-founded in 1998, where he focuses on acquisitions, financing and administrativeissues of portfolio companies. While at Haddington, Mr. Jones has served on over 12 boards of directors of portfolio companies, includingmultiple companies that were ultimately acquired by publicly traded companies, such as Lodi Gas Storage, which was sold to Buckeye Partners,and Bear Paw Energy, which was sold to Northern Border Partners. Prior to the formation of Haddington, Mr. Jones served as Vice Presidentand Chief Financial Officer of Tejas Power Corporation (“TPC”), a publicly traded company, from 1985 until his appointmentas Senior Vice President and Chief Operating Officer in 1995. He also served as a Director of Market Hub Partners, L.P., TPC’snatural gas storage joint venture with Dayton Power & Light, New Jersey Resources, NIPSCO and Public Service Electric and Gas. Priorto his association with TPC, Mr. Jones served as Secretary/Treasurer, and later Chief Financial Officer of The Fisk Group, Inc., a U.S.and international electrical contracting subsidiary of Amec p.l.c., a publicly traded U.K. company. He was employed with The Fisk Groupfrom 1979 to 1985. Mr. Jones began his professional career with the auditing firm Price Waterhouse in Houston, Texas in 1977. He receivedhis BBA degree in Accounting from the University of Texas at Austin in 1977.

Mr.Jones’ qualifications for election to the Board include his experience both in the operation of public company business and servingon the boards of directors of public companies and his related expertise in corporate governance matters.

NOBUKIKURITA Mr. Kurita has served on our Board sinceMarch 2021. Mr. Kurita, who is presently retired, served as President of Sony China Co., Ltd from 2012 to 2016 and as SVP at Sony Corporation(Sony HQ) from 2009 to 2016. While at Sony, Mr. Kurita also served as Chief Executive Officer of Sony Mexico from 1999 to 2003. FromSeptember 2017 to March 2020, Mr. Kurita served as President and Chief Operating Officer of Restar Holdings Corporation (formerly knownas UKC Holdings Corporation) (“Restar”). Restar, which is listed on the Tokyo Stock Exchange, is engaged in trading of semiconductorsand electric devices in Japan and internationally.

| 6 |

Mr.Kurita’s qualifications for election to the Board include his extensive executive leadership expertise and experience, includingserving as a top executive for a publicly traded company in Japan, and his related expertise in marketing, strategic planning, risk management,and technical innovation.

DAVIDG. ROBSON Mr. Robson has served on our Board sinceMarch 2021. Mr. Robson has over twenty-five years of operational, finance and accounting experience and has held senior positions withboth public and private companies in a variety of industries. Since March 2021, Mr. Robson has served as Chief Financial Officer of NuvveHolding Corp., a publicly traded green energy technology company. Mr. Robson has served on the Board of Directors of Payference, a softwarebusiness, since February 2020. Mr. Robson served as the Chief Financial Officer and Chief Compliance Officer of Farmer Brothers Co.,a publicly traded national distributor of coffee, tea and culinary products from February 2017 to November 2019. His responsibilitiesincluded overseeing mergers and acquisitions, investor relations, information technology and finance. Mr. Robson served as the ChiefFinancial Officer of PIRCH, a curator and retailer of kitchen, bath and outdoor home brands, from September 2014 to September 2016. FromJanuary 2012 to September 2014, Mr. Robson was the Chief Financial Officer of U.S. AutoParts, an online provider of auto parts and accessories.Prior to that, he served as the Executive Vice President and Chief Financial Officer of Mervyns LLC, a former discount department storechain, from 2007 to 2011. From 2001 to 2007, he served as the Senior Vice President of Finance and Principal Accounting Officer for GuitarCenter, Inc. Mr. Robson began his career with the accounting firm Deloitte & Touche Tohmastu. Mr. Robson graduated with a Bachelorof Science degree in Accounting from the University of Southern California and is a certified public accountant (inactive) in the Stateof California.

Mr.Robson’s qualifications for election to the Board include his experience as Chief Financial Officer and Chief Compliance Officerof a national distributor of coffee, tea and culinary products as well as his vast operational, finance and accounting experience withboth public and private companies in a variety of industries.

BoardDiversity Matrix

Forthe Annual Meeting, the Board has nominated six individuals who bring valuable diversity to the Board. Their collective experience coversa wide range of professional, geographic and industry backgrounds. The table below provides certain highlights of the composition ofour directors. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

BoardDiversity Matrix (As of January 19, 2022) | ||||||||

| TotalNumber of Directors | 6 | |||||||

| Female | Male | Non-Binary | DidNot DiscloseGender | |||||

| PartI: Gender Identity | ||||||||

| Directors | 1 | 4 | 0 | 1 | ||||

| PartII: Demographic Background | ||||||||

| AfricanAmerican or Black | 0 | 0 | 0 | 0 | ||||

| AlaskanNative or Native American | 0 | 0 | 0 | 0 | ||||

| Asian | 0 | 2 | 0 | 0 | ||||

| Hispanicor Latinx | 0 | 0 | 0 | 0 | ||||

| NativeHawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||

| White | 1 | 2 | 0 | 0 | ||||

| Twoor More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

| LGBTQ+ | 0 | |||||||

| DidNot Disclose Demographic Background | 1 |

| 7 |

Boardand Committee Meetings; Attendance

TheCompany does not have a policy requiring director attendance at its annual meeting of stockholders, but directors are expected to attend.All of our directors observed our last annual meeting remotely, with none of our directors attending in person. During the fiscal yearended September 30, 2021 (“fiscal year 2021”), the Board held twelve meetings, includingtelephonic meetings. During fiscal year 2021, all directors attended at least 75% of the aggregate of the meetings of the Boardand of each of the Board committees on which he or she served at the time.

DirectorIndependence

Werequire that a majority of our Board be independent in accordance with the rules of the Nasdaq Capital Market. Our Board has undertakena review of the independence of our directors and considered whether any director has any direct or indirect material relationship withus that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a resultof this review, our Board has affirmatively determined that Ms. Ging and Messrs. Conner, Jones, Kurita and Robson, representing fiveof our six current directors, and Allen S. Morton, who served as a director until his term ended at the 2021 annual meeting of stockholdersheld on March 3, 2021 (the “2021 Annual Meeting”), all of whom served on the Board during fiscal year 2021, are “independentdirectors” as defined under SEC rules and the listing standards of the Nasdaq Capital Market. All of the current members of theBoard’s committees are also independent under such standards. The Board acts independently of management and regularly holds independentdirector sessions of the Board without members of management present. Mr. Higashida is not considered independent due to his serviceas an executive officer of the Company. In addition, Shanoop Kothari, whose term as a director ended at the 2021 Annual Meeting and whoserved as our Chief Financial Officer until his resignation in August 2021, was also not considered independent due to his service asan executive officer of the Company.

CompensationCommittee Interlocks and Insider Participation

Duringfiscal year 2021, our Compensation Committee consisted of Ms. Ging and Messrs. Jones, Kurita and Robson. In addition, Mr. Morton, whoserved as a director until his term ended at the 2021 Annual Meeting, also served on our Compensation Committee for a portion of fiscalyear 2021. None of the members of our Compensation Committee is or has been one of our employees or officers. None of our executive officerscurrently serves, or during the past fiscal year has served, as a member of the board of directors or compensation committee of anotherentity that has one or more executive officers serving on our Compensation Committee.

Committeesof the Board of Directors

OurBoard has established an audit committee (the “Audit Committee”), the Compensation Committee and the Nominating and CorporateGovernance Committee. The composition and responsibilities of each of the committees of our Board is described below. Members will serveon these committees until their resignation or until as otherwise determined by our Board.

Thecurrent members of the Board and the committees of the Board on which they currently serve are identified in the table below.

| Name | AuditCommittee | CompensationCommittee | NominatingandCorporate GovernanceCommittee | |||

| MasateruHigashida | — | — | — | |||

| KevinJ. Conner | Chairman | — | Member | |||

| TracyGing | — | Member | Member | |||

| J.Chris Jones | Member | Chairman | — | |||

| NobukiKurita | — | Member | Member | |||

| DavidRobson | Member | Member | Chairman |

| 8 |

AuditCommittee

OurAudit Committee is currently composed of Messrs. Conner, Jones and Robson. Mr. Conner serves as the chairperson of our Audit Committee.Our Board has determined that each current member of our Audit Committee meets the requirements for independence and financial literacyunder the applicable rules and regulations of the SEC. Our Board has also determined that each of Messrs. Conner and Robson is an “auditcommittee financial expert” as defined in the rules of the SEC and has the requisite financial sophistication as defined underthe listing standards of the Nasdaq Capital Market. During fiscal year 2021, our Audit Committee met two times.

Theresponsibilities of our Audit Committee include, among other things:

| ● | selectingand hiring the independent registered public accounting firm to audit our financial statements; | |

| ● | overseeingthe performance of the independent registered public accounting firm and taking those actions as it deems necessary to satisfy itselfthat the accountants are independent of management; | |

| ● | reviewingfinancial statements and discussing with management and the independent registered public accounting firm our annual audited andquarterly financial statements, the results of the independent audit and the quarterly reviews, and the reports and certificationsregarding internal control over financial reporting and disclosure controls; | |

| ● | preparingthe audit committee report that the SEC requires to be included in our annual proxy statement; | |

| ● | reviewingthe adequacy and effectiveness of our internal controls and disclosure controls and procedures; | |

| ● | overseeingour policies on risk assessment and risk management; | |

| ● | reviewingand approving related party transactions; and | |

| ● | approvingor, as required, pre-approving, all audit and all permissible non-audit services and fees to be performed by the independent registeredpublic accounting firm. |

OurAudit Committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the rules of theNasdaq Capital Market. A copy of the charter can be found on the Company’s website at https://mynuzee.com/investor-relations/#corporategovernance.

CompensationCommittee

OurCompensation Committee is currently composed of Ms. Ging and Messrs. Jones, Kurita and Robson. Mr. Jones serves as the chairperson ofour Compensation Committee. Our Board has determined that each current member of our Compensation Committee meets the requirements forindependence under the applicable rules and regulations of the SEC. Each current member of the Compensation Committee is a non-employeedirector, as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).During fiscal year 2021, our Compensation Committee met three times.

Thepurpose of our Compensation Committee is to oversee our compensation policies, plans and benefit programs and to discharge the responsibilitiesof our Board relating to compensation of our executive officers. The responsibilities of our Compensation Committee include, among otherthings:

| ● | reviewingand approving compensation of our executive officers and reviewing and recommending to the Board for approval compensation of ourdirectors; | |

| ● | overseeingour overall compensation philosophy and compensation policies, plans and benefit programs for service providers, including our executiveofficers; | |

| ● | reviewing,approving and making recommendations to our Board regarding incentive compensation and equity plans; and | |

| ● | administeringour equity compensation plans. |

OurCompensation Committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the rulesof the Nasdaq Capital Market. A copy of the charter can be found on the Company’s website at https://mynuzee.com/investor-relations/#corporategovernance.

| 9 |

TheCompensation Committee has the authority, in its sole discretion, to select, appoint and retain outside compensation consultants foradvice. The Compensation Committee is directly responsible for the appointment, compensation and oversight of any such consultant, andthe Company is responsible for providing appropriate funding for payment of reasonable compensation to any such consultant, as determinedby the Compensation Committee. The Compensation Committee also has the authority, in its sole discretion, to retain and obtain the adviceand assistance of outside legal counsel and other advisors. In selecting a consultant, outside counsel and other advisors, the CompensationCommittee evaluates its independence by considering applicable rules of the Nasdaq Capital Market and any other factors that the CompensationCommittee deems relevant to the consultant’s independence from management.

Infiscal year 2021, the Compensation Committee retained Sanli Pastore & Hill, Inc. (“SPH”) as an independent consultantto advise it on executive compensation matters. SPH was engaged directly by and reported directly to our Compensation Committee, anddid no other work for the Company. As requested, a representative of SPH communicated with Compensation Committee members outside ofmeetings. The Compensation Committee considered the applicable rules of the Nasdaq Capital Market and determined that SPH qualified asan independent compensation consultant in accordance with applicable SEC and Nasdaq Capital Market rules. For additional informationregarding the role of SPH in determining or recommending the amount or form of executive compensation in fiscal year 2021, see “ExecutiveCompensation — Narrative to Summary Compensation Table.”

Inaddition, in fiscal year 2021, the Compensation Committee also retained Aon/Radford as an independent consultant to advise it on directorcompensation matters. Aon/Radford was engaged directly by and reported directly to our Compensation Committee and did no other work forthe Company. As requested, a representative of Aon/Radford communicated with Compensation Committee members outside of meetings. TheCompensation Committee considered the applicable rules of the Nasdaq Capital Market and determined that Aon/Radford qualified as an independentcompensation consultant in accordance with applicable SEC and Nasdaq Capital Market rules.

TheCompensation Committee charter does not restrict the Compensation Committee from delegating any of its authority or responsibilitiesto individual members of the committee or a subcommittee of the Compensation Committee, although the Compensation Committee didnot delegate any of its responsibilities during fiscal year 2021.

Nominatingand Corporate Governance Committee

TheNominating and Corporate Governance Committee is currently composed of Ms. Ging and Messrs. Conner, Kurita and Robson. Mr. Robson servesas chairperson of our Nominating and Corporate Governance Committee. Our Board has determined that all current members of our Nominatingand Corporate Governance Committee meet the requirements for independence under the applicable rules and regulations of the SEC. Duringfiscal year 2021, our Nominating and Corporate Governance Committee did not hold any formal meetings but acted by unanimous written consentthree times.

Theresponsibilities of our Nominating and Corporate Governance Committee include, among other things:

| ● | identifying,evaluating and selecting, or making recommendations to our Board regarding, nominees for election to our Board and its committees; | |

| ● | evaluatingthe performance of our individual directors; | |

| ● | consideringand making recommendations to our Board regarding the composition of our Board and its committees; | |

| ● | consideringdirector nominees recommended by shareholders; and | |

| ● | developingand making recommendations to our Board regarding corporate governance guidelines and matters. |

OurNominating and Corporate Governance Committee operates under a written charter that satisfies the applicable rules and regulations ofthe SEC and the rules of the Nasdaq Capital Market. A copy of the charter can be found on the Company’s website at https://mynuzee.com/investor-relations/#corporategovernance.

| 10 |

TheCompany has adopted Corporate Governance Guidelines (the “Corporate Governance Guidelines”), which set forth, among otherthings, certain criteria for the Nominating and Corporate Governance Committee to consider in evaluating potential director nomineeswho have the education, business experience, and current insight necessary to understand the Company’s business and be able toevaluate and oversee the direction and performance of the Company. The Nominating and CorporateGovernance Committee is also required to assess whether a director candidate meets all other criteriaas may be established by the Board, including functional skills, corporate leadership, diversity, international experience, or otherattributes that the Board believes will contribute to the development and expansion of the Board’s knowledge and capabilities.While the Company does not have a formal diversity policy, the Board and the Nominating and Corporate Governance Committee believe thatconsiderations of diversity are, and will continue to be, an important component relating to the Board’s composition, as multipleand varied points of view contribute to a more effective decision-making process. For additional information regarding the current compositionof our Board, see “Board Diversity Matrix.”

TheNominating and Corporate Governance Committee will consider director candidates recommended by stockholders. In making recommendationsfor Board nominees for election at any annual meeting of stockholders, the Nominating and Corporate Governance Committee will considerany written suggestions received by our Secretary, not less than 90 nor more than 120 days prior to the anniversary of the date thatthe proxy statement was furnished to our stockholders in connection with the prior year’s annual meeting of stockholders. Suggestionsmust be mailed to our Secretary at the Company’sprincipal executive offices. The manner in which director nominee candidates suggested in accordancewith this policy are evaluated does not differ from the manner in which candidates recommended by other sources are evaluated.

You certainly know how to win a woman's heart. I consider myself lucky to have you. You're worth EVERY SINGLE THING… https://t.co/EP39i1gtlK

— Natalie Maiden {Fake} Wed Jun 23 17:37:49 +0000 2021

BoardLeadership Structure and Role in Risk Oversight

Mr.Higashida is the chairman of the Board and the Company’s Chief Executive Officer. The Company believes that the Chief ExecutiveOfficer is best situated to serve as chairman of the Board because he is the director most familiar with our business and industry andthe director most capable of identifying strategic priorities and executing our business strategy. In addition, having a single leaderprovides clear leadership for the Company. We believe that this leadership structure has served the Company well.

OurBoard has overall responsibility for risk oversight. The Board has delegated responsibility for the oversight of specific risks to Boardcommittees as follows:

| ● | TheAudit Committee oversees the Company’s risk policies and processes relating to the financial statements and financial reportingprocesses, as well as key credit risks, liquidity risks, market risks and compliance, and the guidelines, policies and processesfor monitoring and mitigating those risks. | |

| ● | TheCompensation Committee oversees the compensation of our chief executive officer and our other executive officers and reviews ouroverall compensation policies for employees. | |

| ● | TheNominating and Corporate Governance Committee oversees risks related to the Company’s governance structure and processes. |

Limitationof Liability of Directors and Officers

Pursuantto Nevada Law, the Articles exclude personal liability for our directors and officers for monetary damages based upon any violation oftheir fiduciary duties as directors, except as to liability for any breach of the duty of loyalty, acts or omissions not in good faithor which involve intentional misconduct or a knowing violation of law, or any transaction from which a director or officer receives animproper personal benefit. This exclusion of liability does not limit any right which a director or officer may have to be indemnifiedand does not affect any director’s or officer’s liability under federal or applicable state securities laws. We have agreedto indemnify our directors and officers against expenses, judgments, and amounts paid in settlement in connection with any claim againsta director or officer if he or she acted in good faith and in a manner he believed to be in our best interests.

DelinquentSection 16(a) Reports

Section16(a) of the Exchange Act requires the Company’s officers and directors and persons who own more than ten percent of a registeredclass of the Company’s equity securities to file reports of ownership and changes of ownership with the SEC.

| 11 |

Basedsolely on a review of the SEC filings made by the Company’s officers and directors or written representations from certain reportingpersons, the Company believes that during fiscal year 2021 its officers, directors and beneficial owners of more than ten percent ofCommon Stock were in compliance except for a single group of three late Forms 4 for Messrs. Conner, Jones and Morton reporting grantsof options to acquire shares of Common Stock in November 2020 as compensation for their service as directors of the Company, due to anadministrative error on the part of the Company.

Codeof Ethics

OurBoard has adopted a Code of Business Conduct and Ethics which is applicable to NuZee, Inc. and to all our directors and officers, includingour principal executive officer and principal financial officer.

Acopy of the Company’s Code of Ethics may be obtained free of charge by making the request to the Company in writing or on the Company’swebsite at https://mynuzee.com/investor-relations/#corporategovernance.

DerivativesTrading, Hedging, and Pledging Policies

OurInsider Trading Policy provides that, unless advance approval is obtained from the designated Compliance Officer thereunder, none ofour executive officers or directors (collectively, “Covered Persons”) may acquire, sell, or trade in any interest or positionrelating to the future price of Company securities, such as a put option, a call option, or execute a short sale, or engage in hedgingor monetization transactions or similar arrangements with respect to Company securities. These prohibitions apply whether or not suchCompany securities were acquired through the Company’s equity compensation programs. The objective of this policy is to enhancealignment between the interests of our Covered Persons and those of our stockholders. Company employees who are not executive officersare not subject to the prohibitions described in this paragraph.

Further,our Insider Trading Policy provides that no Covered Person or any Company employee may pledge Company securities as collateral to secureloans. This prohibition means, among other things, that these Covered Persons and Company employees may not hold Company securities ina “margin” account, which would allow the Covered Person or Company employee to borrow against their holdings to buy securities.

StockholderCommunications with Directors

Stockholdersmay communicate their comments or concerns in writing to members of the Board. Any such communication should be addressed to the attentionof the Company’s Secretary at the Company’s principal executive offices. Any such communication must state, in a conspicuousmanner, that it is intended for distribution to the entire Board. Under the procedures established by the Board, upon the Secretary’sreceipt of such a communication, the Company’s Secretary will send a copy of such communication to each member of the Board, identifyingit as a communication received from a stockholder. Absent unusual circumstances, at the next regularly scheduled meeting of the Boardheld more than two days after such communication has been distributed, the Board will consider the substance of any such communication.

DirectorCompensation

Infiscal year 2021, pursuant to a director compensation policy approved by the Board in November 2020, the Company compensated its non-employeeBoard members at a rate of $2,000 per month plus an additional $3,000 for each quarterly Board meeting attended. The Company also reimbursesBoard members for any reasonable out-of-pocket expenses incurred by them in connection with any travel requested by and on behalf ofthe Company in connection with attendance at board and committee meetings. In addition, directors may in the future receive stock optionsto purchase shares of Common Stock at the discretion of our Board.

Asset forth in the Corporate Governance Guidelines, directors who are also employees of the Company will not be paid for Board membershipin addition to their regular employee compensation. Accordingly, Mr. Higashida does not, and Mr. Kothari did not, receive separate compensationfor their service as a director of the Company. Their compensation is discussed and summarized in the Summary Compensation Table includedin this proxy statement.

| 12 |

DirectorCompensation Table

Thefollowing table shows for the fiscal year ended September 30, 2021 certain information with respect to the compensation of our non-employeedirectors who served in fiscal year 2021:

| Name | FeesEarned or Paid in Cash ($) | OptionAwards ($)(1) | Total($) | |||||||||

| KevinJ. Conner(2)(5) | 39,000 | 2,317,476 | 2,356,476 | |||||||||

| TracyGing(3)(5) | 20,260 | 691,818 | 712,078 | |||||||||

| J.Chris Jones(2)(5) | 41,420 | 2,317,476 | 2,358,896 | |||||||||

| NobukiKurita(4)(5) | 18,000 | 1,164,446 | 1,182,446 | |||||||||

| DavidG. Robson(4)(5) | 23,000 | 1,164,446 | 1,187,446 | |||||||||

| AllenS. Morton(2)(6) | 19,692 | 2,317,476 | 2,337,168 |

| (1) | Amountslisted in this column represent the aggregate fair value of the awards computed as of the grant date of each award in accordancewith Financial Accounting Standards Board Accounting Standards Codification No. 718, Compensation-Stock Compensation, or FASB ASCTopic 718, rather than amounts paid to or realized by the named individual. See the notes to our consolidated financial statementsincluded in our Annual Report on Form 10-K for the fiscal year ended September 30, 2021 for a discussion of assumptions made in determiningthe grant date fair value and compensation expense of our stock options. These amounts do not necessarily correspond to the actualvalue that the individuals may realize upon exercise. | |

| (2) | OnNovember 4, 2020, each of Messrs. Conner, Jones and Morton was granted options to purchase 228,323 shares of Common Stock at an exerciseprice of $10.15 per share as equity compensation for their Board service. One half of the options (114,162) were fully vested onthe grant date. With respect to Messrs. Conner and Jones, 57,081 options vested on November 4, 2021 and the remainder of the optionsvest on November 4, 2022 subject to their continued service on the Board. | |

| (3) | OnApril 22, 2021, in connection with the appointment of Ms. Ging to the Board, Ms. Ging was granted options to purchase 228,323 sharesof Common Stock at an exercise price of $3.03. One half of the options (114,162) were fully vested on the grant date. The remainderof the options vest in installments of 57,081 on April 22, 2022 and 57,080 on April 22, 2023. | |

| (4) | OnMarch 18, 2021, in connection with the election of Messrs. Kurita and Robson to the Board, each of Messrs. Kurita and Robson wasgranted options to purchase 228,323 shares of Common Stock at an exercise price of $5.10 per share. One half of the options (114,162)were fully vested on the grant date. The remainder of the options vest in installments of 57,081 on March 18, 2022 and 57,080 onMarch 18, 2023. | |

| (5) | Asof September 30, 2021, each of Ms. Ging and Messrs. Conner, Jones, Kurita and Robson held options to purchase an aggregate of 228,323shares of Common Stock, of which options to purchase 114,162 shares were vested. | |

| (6) | Mr.Morton served as a director until his term ended at the 2021 Annual Meeting. |

| 13 |

SECURITYOWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATEDSTOCKHOLDER MATTERS

Thefollowing table sets forth, as of January 19, 2022, the beneficial ownership of our Common Stock by:

| ● | eachperson, or group of affiliated persons, known by us to beneficially own more than 5% of our Common Stock; | |

| ● | eachof our named executive officers; | |

| ● | eachof our directors; and | |

| ● | allexecutive officers and directors as a group. |

Exceptas otherwise indicated, all shares are owned directly, and the percentage shown is based on 18,204,837 shares of Common Stock issuedand outstanding on January 19, 2022.

Exceptas otherwise indicated below, information with respect to beneficial ownership has been furnished by each director, officer or beneficialowner of more than five percent (5%) of Common Stock. We have determined beneficial ownership in accordance with the rules of the SEC.These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment powerwith respect to those securities. In addition, the rules include shares of our Common Stock issuable pursuant to the exercise of stockoptions that are either immediately exercisable or exercisable within 60 days of January 19, 2022. These shares are deemed to be outstandingand beneficially owned by the person holding those options for the purpose of computing the percentage ownership of that person, butthey are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated,the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficiallyowned by them, subject to applicable community property laws.

Exceptas otherwise indicated below, the address of each person listed in the table below is 1401 Capital Avenue, Suite B, Plano, Texas 75074.

| Nameof Beneficial Owner | Sharesof Common Stock Beneficially Owned | Percentageof Shares of Common Stock Beneficially Owned (2) | ||||||

| Directorsand Named Executive Officers | ||||||||

| MasateruHigashida(1) | 5,164,043 | 27.7 | % | |||||

| PatrickShearer | — | — | ||||||

| JoseRamirez | — | — | ||||||

| ShanoopKothari(2) | 137,215 | * | ||||||

| KevinJ. Conner(3) | 171,243 | * | ||||||

| TracyGing(4) | 114,162 | * | ||||||

| J.Chris Jones(3) | 171,243 | * | ||||||

| NobukiKurita(3) | 171,243 | * | ||||||

| DavidG. Robson(3) | 171,243 | * | ||||||

| AllExecutive Officers and Directors as a group (10 persons)(5) | 6,633,178 | 33.9 | % | |||||

| Allother 5% Stockholders | ||||||||

Entitiesaffiliated with Sabby Management, LLC(6) 10Mountainview Road, Suite 205 UpperSaddle River, New Jersey 07458 | 2,523,244 | (6) | 4.99 | %(7) | ||||

KatsuyoshiEguchi(8) 4-1002,Omori, Moriyama-ku Nagoya-Shi,Aichi-ken, Japan 463-0021 | 913,576 | 5.0 | % |

| 14 |

| * | Representsless than 1% of our outstanding Common Stock. |

| (1) | Includes(a) 14,164 shares of Common Stock owned by NuZee Co., Ltd., an entity 100% owned by Mr. Higashida, and (b) options to purchase 405,334shares of Common Stock that may be exercised within 60 days of January 19, 2022. |

| (2) | Mr.Kothari’s resignation as Chief Financial Officer became effective on August 16, 2021. |

| (3) | Includesoptions to purchase 171,243 shares of Common Stock that may be exercised within 60 days of January 19, 2022. |

| (4) | Includesoptions to purchase 114,162 shares of Common Stock that may be exercised within 60 days of January 19, 2022. |

| (5) | Includesoptions to purchase 1,367,802 shares of Common Stock that may be exercised within 60 days of January 19, 2022. |

| (6) | Includes3,000 shares of Common Stock and, subject to a 4.99% beneficial ownership limitation provision (“Blocker”) described below,1,670,244 shares of Common Stock issuable upon exercise of the Company’s Series A Warrants,and 850,000 shares of Common Stock issuable upon exercise of the Company’s SeriesB Warrants. Number of shares based on information reported on Amendment No. 1 to the Schedule 13G/A filed with the SEC on January4, 2022, reporting beneficial ownership by (a) Sabby Volatility Warrant Master Fund, Ltd., (b) Sabby Management, LLC (“SabbyManagement”), and (c) Hal Mintz, and certain additional information known to the Company. As more fully described in the followingfootnote (7), the Company’s Series A Warrants and Series B Warrants are subjectto a 4.99% Blocker. However, the 2,523,244 shares of Common Stock reported in this table for Sabby Management includes the number ofshares of Common Stock that would be issuable upon full conversion and exercise of the Company’s SeriesA Warrants and Series B Warrants and do not give effect to such Blocker. |

| (7) | Pursuantto the terms of the Company’s Series A Warrants and Series B Warrants, Sabby Managementcannot exercise the Series A Warrants and Series B Warrants to the extent Sabby Managementwould beneficially own, after any such exercise, more than 4.99% of the outstanding shares of our Common Stock (again, the “Blocker”).The 4.99% percentage set forth herein for Sabby Management gives effect to the Blocker. |

| (8) | Numberof shares based on information reported on Schedule 13D filed with the SEC on September 25, 2020, reporting beneficial ownership by(a) Katsuyoshi Eguchi, (b) Eguchi Holdings Co, Ltd. (“Eguchi Holdings”), (c) EGC Co., Ltd. (“EGC”), and (d)Gold Coast LLC (“Gold Coast”). According to the report, (i) Mr. Eguchi has sole voting and dispositive power over 390,712shares and shared voting and dispositive power over 522,864 shares, (ii) Eguchi Holdings has shared voting and dispositive power over495,363 shares, (iii) EGC has shared voting and dispositive power over 6,667 shares, and (iv) Gold Coast has shared voting and dispositivepower over 20,834 shares. According to the report, Mr. Eguchi is the Chief Executive Officer of Eguchi Holdings, the chairman of theboard of directors of EGC, and the sole equity owner of Gold Coast, and, as such, is in the position to determine the investment andvoting decisions made by each of Eguchi Holdings, EGC, and Gold Coast. |

| 15 |

CERTAINRELATIONSHIPS AND RELATED TRANSACTIONS

Otherthan the director and executive officer compensation arrangements discussed herein in the sections titled “Director Compensation”and “Executive Compensation”, there has not been any transaction or series of transactions since October 1, 2019, nor isthere any currently proposed transaction, in which:

| ● | wehave been or are to be a participant; | |

| ● | theamount involved exceeded or will exceed the lesser of (i) $120,000 or (ii) 1% of the average of the Company’s total assetsat year end for the last two completed fiscal years; and | |

| ● | anyof our directors, executive officers or, to our knowledge, beneficial owners of 5% or more of our capital stock, or any immediatefamily member of or person sharing the household with any of these individuals or entities, had or will have a direct or indirectmaterial interest. |

Controlby Officers and Directors

Ourofficers and directors and their affiliates beneficially own, in the aggregate, approximately 33.9% of our outstanding Common Stock asof January 19, 2022. As a result, in certain circumstances, these stockholders acting together may be able to determine matters requiringapproval of our stockholders, including the election of our directors, or they may delay, defer or prevent a change in control of us.See “Security Ownership of Certain Beneficial Owners and Management” herein.

| 16 |

PROPOSAL2 – ADVISORY VOTE APPROVING NAMED EXECUTIVE OFFICER COMPENSATION

Inaccordance with Section 14A of the Exchange Act and Rule 14a-21(a) promulgated thereunder, we are asking our stockholders to approve,in a non-binding advisory vote, the compensation of our named executive officers (our “NEOs”) as disclosed in this proxystatement pursuant to Item 402 of Regulation S-K. This proposal, commonly known as a “Say on Pay” proposal, gives stockholdersthe opportunity to provide input – to endorse or not endorse –the compensation of our NEOs. Unless the Board modifies itspolicy of holding an advisory “Say on Pay” vote on an annual basis, the next advisory Say on Pay” vote will be heldat our 2023 annual meeting of stockholders.

Westrongly encourage you to carefully review the Executive Compensation discussion and compensation tables and narrative discussions andrelated material included in this Proposal 2. Thereafter, we request your input on the compensation of our NEOs through your vote onthe advisory resolution that follows the Executive Compensation discussion.

EXECUTIVECOMPENSATION

OurNEOs for fiscal year 2021, consisting of our principal executive officer, our next two most highly compensated executive officers, andone additional individual who would have been one of our two most highly compensated executive officers (aside from our principal executiveofficer) during fiscal year 2021, but for the fact that he was not serving as an executive officer as of September 30, 2021, were:

| ● | MasateruHigashida, Chief Executive Officer, President, Treasurer, Secretary and Chairman of the Board; | |

| ● | PatrickShearer, Chief Financial Officer; | |

| ● | JoseRamirez, Chief Sales Officer & Chief Supply Chain Officer; and | |

| ● | ShanoopKothari, Former Chief Financial Officer. |

SummaryCompensation Table

Thefollowing table sets forth information regarding the compensation earned by each of our NEOs during the fiscal years ended September30, 2021 and September 30, 2020.

| Nameand Principal Position | Year | Salary($) | Bonus($) | StockAwards ($) | OptionAwards ($)(1) | AllOther Compensation ($) | Total($) | |||||||||||||||||||||

| MasateruHigashida | 2021 | 230,000 | 20,500 | — | 0 | (6) | — | 250,500 | (6) | |||||||||||||||||||

| ChiefExecutive Officer, President, Secretary, Treasurer | 2020 | 180,000 | 88,100 | (5) | — | — | — | 268,100 | ||||||||||||||||||||

| PatrickShearer (2) | 2021 | 57,852 | 41,000 | — | 623,999 | — | 722,851 | |||||||||||||||||||||

| ChiefFinancial Officer | ||||||||||||||||||||||||||||

| JoseRamirez (3) | 2021 | 85,240 | 7,200 | — | 527,400 | (7) | — | 619,840 | ||||||||||||||||||||

| ChiefSales Officer & Chief Supply Chain Officer | ||||||||||||||||||||||||||||

ShanoopKothari (4) | 2021 | 229,152 | 75,000 | 1,251,402 | (8) | — | 9,684 | (9) | 1,565,238 | |||||||||||||||||||

| FormerChief Financial Officer | 2020 | 225,000 | 100,000 | — | — | — | 325,000 |

| (1) | Amountslisted in this column represent the aggregate fair value of the option awards computed asof the grant date of each option award in accordance with FASB ASC Topic 718, rather thanamounts paid to or realized by the named individual. See the notes to our consolidated financialstatements included in our Annual Report on Form 10-K for the fiscal year ended September30, 2021 for a discussion of assumptions made in determining the grant date fair value andcompensation expense of our stock options. These amounts do not necessarily correspond tothe actual value that the NEOs may realize upon exercise. As further described in footnotes6 and 7 below, a portion of the option awards granted in fiscal year 2021 are subject toperformance-based vesting conditions. The grant date fair value for any performance-basedoption awards is based on the probable outcome of the performance conditions as of the grantdate. |

| 17 |

| (2) | Mr.Shearer was appointed Chief Financial Officer on July 2, 2021. | |

| (3) | Mr.Ramirez was appointed Chief Sales Officer & Chief Supply Chain Officer on May 10, 2021. | |

| (4) | Mr.Kothari’s resignation as Chief Financial Officer became effective on August 16, 2021.In connection with Mr. Kothari’s resignation, we entered into a Severance Agreementand General Release with Mr. Kothari on July 2, 2021 (the “Severance Agreement”).For additional information regarding the Severance Agreement, see “—Narrativeto Summary Compensation Table—Mr. Kothari.” | |

| (5) | Infiscal year 2021, Mr. Higashida was awarded deferred bonuses totaling $88,100 for his serviceto the Company in the prior fiscal year ended September 30, 2020. | |

| (6) | OnJuly 2, 2021, Mr. Higashida was granted performance-based options to purchase 896,743 sharesof Common Stock, which represents the total number of performance-based options that maybe earned, if at all, in the event the performance conditions are fully achieved. The valueof these performance-based options as reported in the Summary Compensation Table has beencalculated assuming that none of the performance conditions will be met, which the Companybelieves to be the most probable outcome giventhat the performance conditions are based on the Company achieving exceedinglysuperior results relative to the Company’s recent historical results of operations.If the value of these performance-based options were to be calculated assuming that the performanceconditions were fully satisfied, the value for these performance-based options would be $2,797,832and Mr. Higashida’s total compensation as reported in the Summary Compensation Tablefor fiscal year 2021 would be $3,048,332. For additional information regarding Mr. Higashida’sperformance-based options, see “—Narrative to Summary Compensation Table—Mr.Higashida.” | |

| (7) | OnMay 10, 2021, Mr. Ramirez was granted (i) time-based options to purchase 30,000 shares ofCommon Stock, and (ii) performance-based options to purchase 150,000 shares of Common Stock,which represents the total number of performance-based options that may be earned, if atall, in the event the performance conditions are fully achieved. For additional informationregarding Mr. Ramirez’s options, see “—Narrative to Summary CompensationTable—Mr. Ramirez.” | |

| (8) | Thisamount represents (i) the grantdate fair value of 152,215 restricted sharesof Common Stock granted to Mr. Kothari in January 2021, which were approved by the CompensationCommittee in consultation with SPH, and (ii) in connection with Mr. Kothari’s resignation,the incremental fair value of 50,737 outstanding restricted shares of Common Stock that wereaccelerated to vest on August 16, 2021 pursuant to the Severance Agreement, in each casecomputed in accordance with FASB ASC Topic 718. Seethe notes to our consolidated financial statements included in our Annual Report on Form10-K for the fiscal year ended September 30, 2021 for additional information regardingthe grant date fair value and compensation expense of these restricted shares. | |

| (9) | Pursuantto the Severance Agreement, Mr. Kothari was entitled to reimbursement for premiums paid tocontinue health, dental and vision insurance pursuant to COBRA until the earlier of December31, 2021 or the date on which Mr. Kothari became ineligible to participate in such COBRAcoverage. |

Narrativeto Summary Compensation Table

Thereare no arrangements or plans in which we provide pension, retirement or similar benefits for our executive officers. Our executive officersmay receive stock options and restricted stock at the discretion of our Board in the future. We do not have any material bonus or profitsharing plans pursuant to which cash or non-cash compensation is or may be paid to our executive officers, except that stock optionsor restricted stock may be granted at the discretion of our Board from time to time. Except as described below under “— ExecutiveEmployment Agreements,” we have no plans or arrangements in respect of remuneration received or that may be received by our executiveofficers to compensate such officers in the event of termination of employment (as a result of resignation, retirement, change of control)or a change of responsibilities following a change of control.

| 18 |

Thefollowing paragraphs provide further detail regarding the compensation of our NEOs for fiscal year 2021.

Mr.Higashida

OnJuly 2, 2021, Mr. Higashida was granted performance-based options to purchase 896,743 shares of Common Stock, which represents the totalnumber of performance-based options that may be earned, if at all, in the event the performance conditions are fully achieved, as furtherdescribed below. Mr. Higashida’s performance-based options will vest, if at all, based on the extent to which the Company achievescertain performance objectives relating to our earnings before income taxes in each of fiscal year 2022, fiscal year 2023 and fiscalyear 2024. Pursuant to the award agreement, (i) 179,349 performance-based options shall vest, if at all, in fiscal year 2022, (ii) 269,023performance-based options shall vest, if at all, in fiscal year 2023, and (iii) 448,371 performance-based options shall vest, if at all,in fiscal year 2024, in each case based upon our achievement of a specified amount of earnings before income taxes in the respectivefiscal year. For this purpose, earnings before income taxes means “operating income, minus interest expense and other expense,plus other non-operating income and income (loss) from investment in unconsolidated affiliate(s), before income tax (benefit) expense,all as calculated in accordance with U.S. GAAP.” The performance-based options have an exercise price of $3.12 per share and willexpire ten years from the grant date, unless terminated earlier as provided by the award agreement.

OnJuly 2, 2021, the Compensation Committee approved an increase in the annual base salary payable to Mr. Higashida from $180,000 to $300,000,effective as of May 23, 2021.

Mr.Shearer

Weentered into an employment agreement with Mr. Shearer, dated as of July 2, 2021, in connection with his appointment as our Chief FinancialOfficer (the “Shearer Employment Agreement”). For Mr. Shearer’s salary and bonus information pursuant to the ShearerEmployment Agreement, see “—Executive Employment Arrangements—Agreement with Mr. Shearer.”

OnJuly 2, 2021, pursuant to the Shearer Employment Agreement, Mr. Shearer was granted time-based options to purchase 200,000 shares ofCommon Stock. Subject to Mr. Shearer’s continued employment, the options vest as follows: (i) 80,000 options shall vest on July2, 2022; (ii) 60,000 options shall vest on July 2, 2023; and (iii) 60,000 options shall vest on July 2, 2024. The options have an exerciseprice of $3.12 per share and will expire ten years from the grant date, unless terminated earlieras provided by the award agreement.

Mr.Ramirez

Weentered into an employment agreement with Mr. Ramirez, dated as of May 7, 2021, in connection with his appointment as our Chief SalesOfficer & Chief Supply Chain Officer (the “Ramirez Employment Agreement”). For Mr. Ramirez’s salary and bonus informationpursuant to the Ramirez Employment Agreement, see “—Executive Employment Arrangements—Agreement with Mr. Ramirez.”

OnMay 10, 2021, pursuant to the Ramirez Employment Agreement, Mr. Ramirez was granted (i) time-based options to purchase 30,000 sharesof Common Stock, which vest as to one third on each anniversary of the grant date, and (ii) performance-based options to purchase 150,000shares of Common Stock, which represents the total number of performance-based options that maybe earned if the performance conditions are fully achieved, as further described below. Pursuant to the award agreement for the performance-basedoptions, (i) 30,000 performance-based options were to vest, if at all, in the period from May 10, 2021 to September 30, 2021, and (ii)a maximum of 40,000 performance-based options shall vest, if at all, in each of fiscal years 2022, 2023 and 2024, in each case basedupon our achievement of a specified amount of adjusted gross sales in the respective period or fiscal year, as the case may be. The optionshave an exercise price of $2.91 per share and will expire ten years from the grant date, unless terminated earlier as provided by theaward agreements. For purposes of Mr. Ramirez’s performance-based options, “adjusted gross sales” means thegross sales of products as invoiced by the Company or its affiliates, sub-licensees or its marketing partners to third parties, lessdeductions for returns (including withdrawals and recalls), rebates or chargebacks, volume discounts granted at the time of invoicing,sales taxes and other taxes directly linked and included in the gross sales amount for the countries concerned in accordance with theCompany’s then current standard practices. Following the end of fiscal year 2021, performance-based options to acquire 30,000 sharesof Common Stock were forfeited because the performance conditions ($2.5 million in adjusted gross sales) were not satisfied in the applicableperformance period from May 10, 2021 to September 30, 2021.

| 19 |

Mr.Kothari

OnJune 22, 2021, Mr. Kothari notified us of his resignation as Chief Financial Officer. Mr. Kothari’s resignation became effectiveon August 16, 2021. In connection with Mr. Kothari’s resignation, we entered into the Severance Agreement with Mr. Kothari on July2, 2021. Pursuant to the Severance Agreement, Mr. Kothari’s 50,737 outstanding restricted shares of Common Stock were acceleratedto vest on August 16, 2021, the date that our Quarterly Report on Form 10-Q was timely filed with the SEC. In addition, pursuant to theSeverance Agreement, Mr. Kothari was entitled to reimbursement for premiums paid to continue health, dental and vision insurance pursuantto COBRA until the earlier of December 31, 2021 or the date on which Mr. Kothari became ineligible to participate in such COBRA coverage.

OutstandingEquity Awards at Fiscal Year End

Thefollowing table sets forth information regarding outstanding equity awards held by our named executive officers as of September 30, 2021:

| OptionAwards | ||||||||||||||||||||||

| Name | GrantDate | Numberof Securities Underlying Unexercised Options Exercisable (#) | Numberof Securities Underlying Unexercised Options Unexercisable (#) | EquityIncentive Plan: Number of Securities Underlying Unexercised Unearned Options (#) | OptionExercise Price ($) | OptionExpiration Date | ||||||||||||||||

| MasateruHigashida | 07/20/2017 | 405,334 | 101,333 | (1) | 1.68 | 07/20/2027 | ||||||||||||||||

| 7/2/2021 | — | — | 896,743 | (2) | 3.12 | 7/2/2031 | ||||||||||||||||

| PatrickShearer | 7/2/2021 | — | 200,000 | (3) | — | 3.12 | 7/2/2031 | |||||||||||||||

| JoseRamirez | 5/10/2021 | — | 30,000 | (4) | — | 2.91 | 5/10/2031 | |||||||||||||||

| 5/10/2021 | — | — | 150,000 | (5) | 2.91 | 5/10/2031 | ||||||||||||||||

| ShanoopKothari | 4/01/2019 | 133,333 | (6) | — | 19.50 | 11/16/2021 | (6) |

| (1) | Theoptions vest, subject to Mr. Higashida’s continued employment, on July 20, 2022. | |