By Dave Donovan

After revolutionizing equity trading for the masses, Robinhood now announced the launch of crypto wallets, signaling its entrance to the next financial revolution. More than 2 million people have been on the app’s waiting list for such a feature since last year. That’s not so surprising, as anyone who wants to transact on metaverse platforms, acquire NFTs, engage in cross-border transactions or enter the growing crypto-trading market needs a crypto wallet. But this immense demand by consumers like you and me is also a lot of lost business for banks, who have for the most part hesitated to offer crypto services for retail customers, especially in the United States. And it’s more than that: As long as banks continue to sit out the crypto game for retail customers, waiting for regulation, while fintech startups and foreign central banks, including in China, where the digital yuan is growing in popularity, continue to innovate and capture the immense consumer demand for digital currency services, the American banking sector risks falling behind.

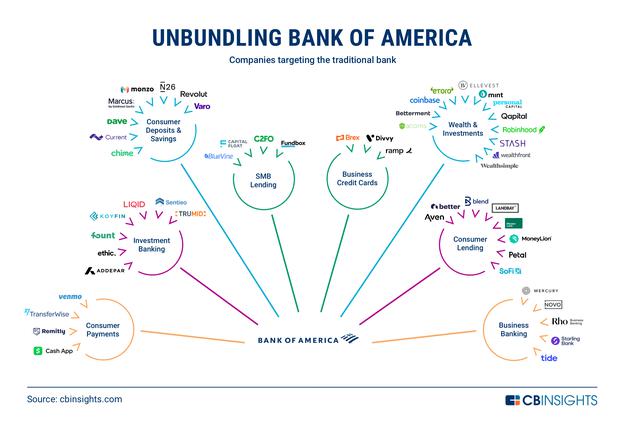

American banks need to understand the threat that crypto presents, and take a few simple steps to not only protect their business, but the sector as a whole. They need to fully embrace crypto service for the masses; right now banks are only starting to offer such services to a few big customers, which may be safer, but will ultimately leave them behind.

Offer basic crypto services for everyone now

The media has been full of stories about some banks taking small steps to offer some crypto services to high-wealth individuals and fund-managers, portraying the banks as finally starting to get on board. Especially in the case of investment banking giant JP Morgan, which issued its own digital coin back in 2019–only to quickly limit its use to internal purposes on regulatory worries– there have been some pioneering steps, no doubt. But as long as banks are not offering these services to the retail banking sector, which is growing more than 4% a year, it won’t have a large-scale impact. It should be remembered that the current value of personal savings in the United States is almost twice as large as the value of M&A deals overseen by investment banks in 2021.

While there is no question that the U.S. government should regulate crypto–as such steps are badly needed to encourage more financial innovation and maintain global competitiveness–banks should not wait for regulation to start serving consumers. Waiting is wasting precious time. The banks that will come out ahead will be those that launch the basic services needed for crypto: custody, key management and wallet services that compete with platforms like Coinbase. A Cornerstone Advisors survey shows that 60% of crypto holders would keep those assets with their banks, if it were possible. That is a potentially huge audience at the ready, and American banks should grab it before losing out to fintechs or foriegn banks in the future economy.

Private key management would not only open the door to a new line of business, but would perhaps be more attractive than what many crypto platforms offer because banks could act as a backup to those who lose or forget their private keys, preventing consumers from being locked out of their accounts. Currently, for the most part, forgetting a private key is like losing cash; there is no way to access the coins.

Finally, there is no good reason that banks are not offering crypto wallets. In fact, when it comes to opening wallets, which can be quite cumbersome even on the most popular platforms, banks even have an opportunity to take the lead by focusing on creating a seamless customer experience on platforms familiar to their client base. As the payment sector, including some legacy players like MasterCard, zooms ahead in incorporating crypto, banks need to be onboard–or risk irrelevance.

Leverage the legacy of trust

With concerns about fraud, cybersecurity and how to handle “identity” in the metaverse, banks could potentially play an important role by offering identification and verification services for crypto payments, NFTs or other blockchain based transactions. Startups are already offering such services. But banks, with long track records of consumer trust, could play a large role here, and they should start now while the field is still young and open. These services, along with custody, key management and wallet services, can also help banks capture new revenue streams, which will be especially important as the rise of blockchain options puts increasing pressure on some of banking’s traditional fee structures, especially those linked to money transfers and payments.

It is important to remember that when it comes to any crypto-related services, including identity verification, that banks are not just competing with other banks or fintechs, but with potentially any brand. Just as the world has seen the lines blur between banks and retailers in the payment space– just think of how brands like Walmart, Kroger and Uber have launched financial services over the last decade–the same pattern applies in the crypto sector.

Stick to stable coins

Another way for banks to ease into the crypto services sector for retail consumers while minimizing what they perceive as risk to customers, could be to only offer services for stable coins, those linked to fiat currencies, like the yuan, or, potentially, the digital dollar, which the Biden administration hinted could be coming in an executive order signed last month. Working only with stable coins would be a way for banks to avoid dealing with the volatility and perceived risks of cryptocurrencies, whose values change wildly.

At the same time, it cannot be stated enough that for most of their history, banks have been offering customers volatile and risky investments all the time, whether those be commodities or financial instruments–look at the fluctuations in the price of oil, or, more dramatically, at the saga of mortgage-backed securities. Arguing that crypto is risky is not a good reason for banks to continue to sit on the sidelines when it comes to offering the basic services to retail customers like you and me.

I am optimistic that U.S. regulators will offer more clarity regarding crypto by the end of this year, which will no doubt make it easier for banks to navigate the space. But banks should not wait. Now is the time to move beyond offering crypto services to just a few wealthy clients or fund managers – by opening retail crypto divisions, banks will be able to tap into the rapid financial innovation connected to the growth of the crypto economy.

Eventually, as the recent news from Robinhood and WeChat shows, there will no longer be such a thing as the crypto economy. Rather, there will just be an economy increasingly underpinned by cryptocurrencies, stable coins and blockchain technology. The steps American banks choose to take–or not take–today will determine their role in shaping that economy.