Decentralised Finance (DeFi) is changing the way we borrow or lend: Explainer

Traditionally, borrowing and lending have required an intermediary like a bank or other financial institution.

The bank facilitates the transaction and reduces risks by doing background checks using Know Your Customer (KYC) and credit scores.

Here, a borrower pledges property, jewellery etc., as collateral, and the lender gives loans and earns interest. The crypto industry is set to change the way this is done. How? It will do that by decentralised finance (DeFi).

The rapid rise of the $2 trillion industry has opened floodgates of innovation in the underlying blockchain technology.

This technology promises to remove any intermediaries like banks and allow the borrower to directly deal with the lender through smart contracts in a decentralised manner.

In simple terms, smart contracts are self-executing electronic codes embedded with the rules of transactions.

These rules, for instance, can be the loan amount, the fixed interest rates, and the expiry date of the contract. These rules execute themselves when the conditions set for them are satisfied. So there's no need for third party involvement.

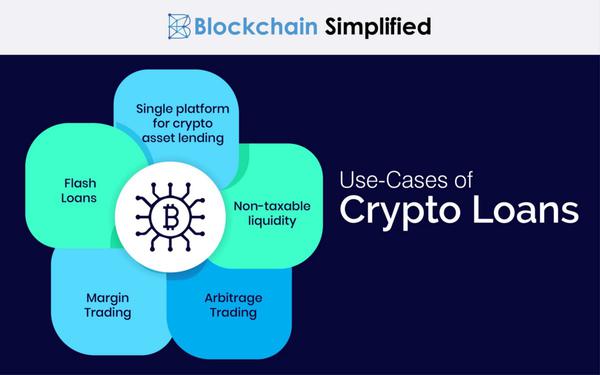

People can obtain a loan by pledging crypto assets on a DeFi platform.

Similarly, users can deposit their crypto assets in a DeFi protocol smart contract and become lenders.

After depositing the crypto assets, the platform can offer them their redeemable native tokens to represent the principal and the interest.

But how can users identify the right platform to make this trade in the decentralised world?

One way to do so is to study the protocol's performance by understanding its total value locked (TVL).

As the name suggests, TVL is an indicator of the value of the assets staked in smart contracts on that platform. The higher the TVL, the more secure the platform is.

PromotedListen to the latest songs, only on JioSaavn.comCrypto users are rapidly moving to accept smart contract platforms, making them a major part of the crypto ecosystem.

The benefits include a lower cost of the transaction, higher execution speed, and greater efficiency. It's also a transparent system.