Share to Facebook

Share to Twitter

Share to Linkedin

Red and blue bar magnet with iron powder showing magnetic field lines

getty

This will be the first in a series of three blogs on advances in digital storage and memory and the systems built with these technologies and how that will impact the storage industry going into 2021.This initial blog (as prior years’ projections blogs) will discuss advances in magnetic recording, which have enabled magnetic hard disk drives and magnetic tape recording.

HDD shipments into several markets continues to decline as SSD prices are low with an oversupply of NAND flash in the market.Currently client SSDs are less than 5X the price of HDDs per TB and at that price point and with many applications such as most client PCs comfortable with 1-2 TB of storage, SSDs are an attractive option (often with more storage in the cloud). As a consequence, SSD are increasing as a percentage of PC storage. Likewise, HDD shipments continue to decline in consumer and performance enterprise applications (e.g. the move by gaming consoles to SSDs rather than HDDs on the latest models).

On the other hand, enterprise HDDs remain close to 10X the price of enterprise SSDs and nearline high-capacity HDDs are on a general growth curve.In particular, data center spending early in the COVID-19 pandemic on nearline HDDs boosted sales in 2020, which we project will have increased to about 14% more nearline drives shipped in 2020 than in 2019.We are projecting a bit slower growth in 2021 at 10% more nearline units YoY (as we go off a peak in data center spending that was extended into 2020 with spending to support remote work and streaming in 2020).

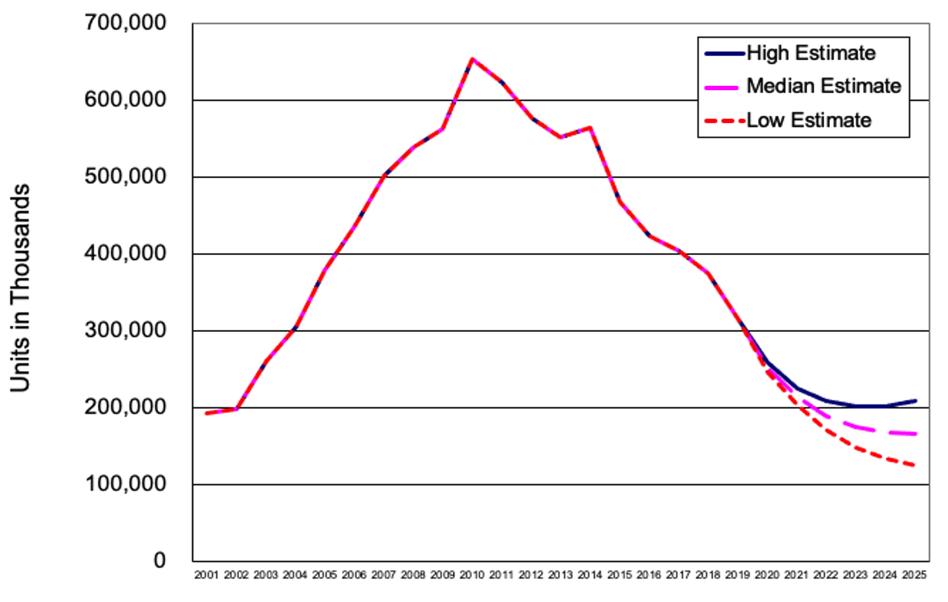

Total 2020 HDD shipments through C3Q 2020 total 190M. We project C4Q 2020 shipments will be between 60 and 65M units, resulting in 250-255M total HDD shipments for the calendar year, down 19-21% from 316.3M shipped in 2019. The total decline in HDD shipments between 2018 and 2019 was 15.7%.Total projected HDD shipment in in 2021 are 214M units, down about 15% from 2020.The figure below shows out updated projections for total HDD shipments out to 2025 including high, median and low estimates from 2020 to 2025.

HDD Historical and Projected Shipments

Image from Coughlin Associates

MORE FOR YOU

Lernico Closes The $6.5 Trillion Skill Gap Starting In Latin America With Online, Cohort-Based Learning

Synopsys, Cadence, Google And NVIDIA All Agree: Use AI To Help Design Chips

Qualtrics’s $1.125B Acquisition Of Clarabridge Upends The Customer Feedback Management Market

Total projected HDD exabyte shipments are estimated at 1.0 Zetabytes (ZB) in 2020.By 2025 total HDD annual capacity shipments should exceed 2.5 ZB.

With the growing number of HDD sales being for higher margin high capacity nearline drives the average sales price (ASP) for HDDs has been generally increasing, as shown below through C3Q20 (the drop in C3Q20 was due to increases in client computing devices, likely for remote work during that quarter).

HDD Quarterly Average Sales Price History (1998 through C3Q20)

Image from Coughlin Associates

The pie chart below shows shipping unit market share through C3Q20 for 2020, which will likely be about the same for all of 2020.Note that Toshiba’s share of the HDD business is back up to 20% after dealing with supply chain issues early in the Covid pandemic (Toshiba share was 24% in 2019).

HDD Market Share through CQ3 2020

Image from Coughlin Associates

In order to remain competitive with SSDs, HDDs must continue to increase the HDD areal density (the amount of information that can be stored on a given area of the disk surface).This is the major component to enabling HDDs to remind at a significant $/TB advantage versus SSDs.The Figure below shows maximum announced product areal density for HDDs, showing little improvement in the maximum areal density since 2015.Some folks in the industry have said that HDD areal density increases have been at something like 8% GAGR.

HDD Shipping Product Areal Density Growth

Image from Coughlin Associates

Even though areal density growth has slowed, HDD capacities have grown by increasing the number of disks in the drive using He-sealed HDDs.HDDs with up to 9 disks are available today and there are discussions about increasing this to 10-12 disks.If this is to fit into a conventional 3.5-inch HDD form factor, this would likely drive the use of glass or glass ceramic disk substrates, currently used by some, but not by other HDD manufacturers.As mentioned in our 2020 projection blog there are ideas that may allow more disks in a 3.5-inch form factor such as L2’s HDDs with a partial vacuum to achieve even higher disk count and areal density than is possible with He-filled HDDs.

The HDD companies have also turned to energy assisted magnetic recording to increase magnetic recording areal density.In 2020 Western Digital and Seagate both announced that they were shipping energy assisted HDDs for data center and enterprise qualifications.In WDC’s case their products used a bias current applied to the write head to reduce written jitter as an energy assist technology.

Seagate’s 20TB HDD product implemented heat assisted magnetic recording (HAMR).WDC and Toshiba have announced in the past couple of years that they plan to supply HDDs using microwave assisted magnetic recording (MAMR).Seagate has projected that HAMR would enable 30TB HDDs in 2023 with 50 TB HDDs possible by 2026.WDC or Toshiba are likely to introduce their own HAMR or MAMR HDDs in 2021.

HDD storage capacities are increasing at greater rates than the data rate from the HDDs.This causes problems in storage system design (such as slower drive rebuilds) and is driving developments to increase the data rate of the HDD.Seagate and WDC have both demonstrated dual stage actuator HDDs and are sending these products out for enterprise and data center qualifications.There are reports of system designs using dual stage actuator HDDs that could result in announcements of practical storage systems in 2021.

Both Seagate and WDC are using RISC-V cores in their storage products, WDC seems to have moved to almost 100% RISC-V processors in their SSDs, HDDs and storage systems (with their SweRV cores).At the 2020 RISC-V Summit WDC said that it had two varieties of SweRV cores.The first is their EH2 dual-threaded core for high random read IOPS.The second is their EL2 low power core for sequencers and state machines.WDC also discussed their OmniXtend that allows sharing main memory with various types of processors.Seagate announced their use of a RISC-V core for real-time processing of motion control information for HDD head positioning.Seagate is also using RISC-V for its OpenTitan root of trust to provide data trust worthiness at the edge.

Magnetic tape uses the same basic magnetic recording technology as hard disk drives. These products continue to play an important role in data archiving for the cloud as well as on-premises data centers.Magnetic tape LTO is the magnetic tape leader at about 80% of the market and IBM enterprise tape is most of the balance. In 2019 LTO-9 was introduced with 18TB native storage capacity (it was on the roadmap originally at 24TB).The revised LTO roadmap is shown below.

LTO Magnetic Tape Capacity Roadmap

Image from Ultrium LTO

The Ultrium LTO consortium projects its generation 10 as twice the native storage capacity of LTO 9 and future generations are projected to provide a 2X capacity increase over the prior generation.LTO 9 tape has magnetic recording areal density of about 13.5Gbpsi, while HDD areal density is a bit over 1 Tbpsi (tape has about 1/10

th

the areal density of HDDs).As a consequence, magnetic tape has a lot of magnetic technology available that could be applied to increase tape storage capacity.

IBM and Fujifilm made a magnetic tape technology demonstration in 2015 showing a 123 Gbps areal density using Barium Ferrite (BaFe) particle tape (making a 220TB half inch tape cartridge possible).IBM and Sony achieved a 201 Gbpsi (making a 330TB tape cartridge possible) sputtered magnetic media in a demonstration in 2017.

In December 2020 IBM and Fujifilm demonstrated a world’s highest magnetic tape recording areal density of 317 gigabits per square inch (Gbpsi), enabling a 580TB half inch tape cartridge.This would be 29 times greater native storage capacity than IBM’s largest enterprise tape cartridge at 20TB.Magnetic tape is widely used for archiving data and provides inexpensive storage for data that doesn’t require fast access.Tape is used in major data centers for their cold storage. The total market for magnetic tape media, drives and tape libraries is probably over $2B.The latest IBM and Fujifilm demonstration used Strontium Ferrite (SrFe) particle magnetic media.

IBM is the sole manufacturer of magnetic tape drives and Fujifilm along with Sony, are the only remaining manufacturers of magnetic tape.The IBM researchers point out that because of the availability of magnetic recording technology that could be used in tape, the magnetic tape industry believes that it can continue at 34% per year areal density growth.They compared this to recent areal density growth of HDDs, which has been in the range of 8% per year areal density growth in recent years.

The chart from iNSIC a storage industry trade group is shown in the chart below, showing HDD product and demonstration areal density growth as well as tape shipping product areal density growth, including the 317 Gbpsi demonstration.

iNSIC Tape versus HDD Roadmap

Image from iNSIC

The IBM folks felt that because the tape areal density growth greatly exceeds that of HDDs, that tape would displace HDDs for colder storage.On the other hand, the HDD companies are starting to ship HDDs using energy assisted magnetic recording and projecting something like a 20% annual areal density growth for the next few years, so the magnetic tape advantage may not be as great.

HDD use is declining for many applications, but it is growing in use for secondary storage in data centers (with SSDs increasingly used for primary storage) with high capacity nearline HDDs.Magnetic tape is used by many enterprises and cloud data centers for long term data archiving.For all these magnetic recording technologies, higher capacities will be required to store the explosion of data expected over the next decade.