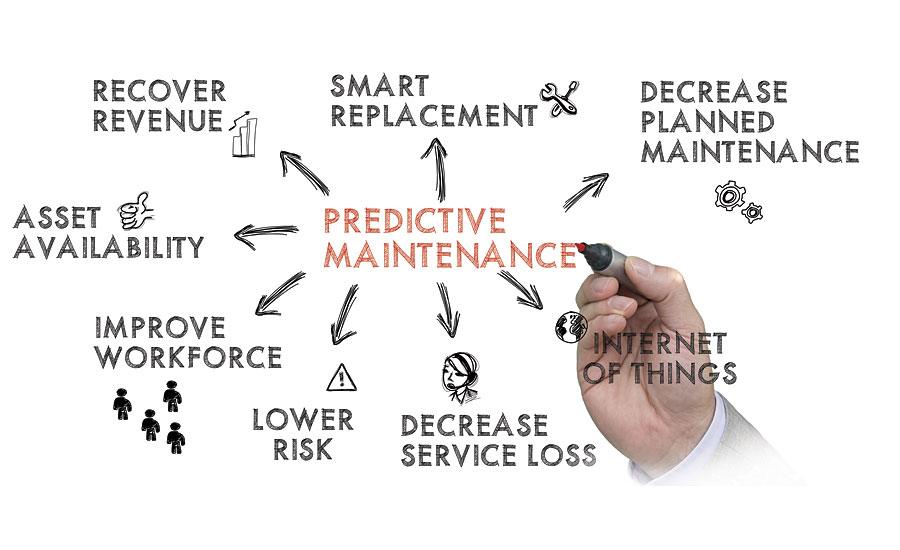

Telematics in the heavy-dutytrucking industry is creating large amounts of data, which will increase astrucks become more technologically advanced with sensors being added to seeminglyevery component on the vehicle. All this data can be used to provide predictivemaintenance information for fleets to decrease their trucks’ downtimes.

However, the key isn’tnecessarily more data. It’s clean, optimized data that provides actionableinformation for aftermarket distributors, suppliers and fleets.

“The very business model ofcommercial vehicles has changed fundamentally. In 2022, the problem to solve iswhat the truck can do for me,” in the data it provides, said Sandeep Kar, Noregonchief strategy officer, during a session, “Paving the Way: How the Heavy-DutyAftermarket Can Profit from Telematics and Predictive Maintenance,” held lastweek at Heavy Duty Aftermarket Week 2022 in Grapevine, Texas.

If a fault light comes on in atruck in transit, “technology exists today to guide that vehicle to a serviceand maintenance location. That service and maintenance location now knows this vehicleis coming in with this part or service requirement, which reduces dwell time,”Kar said. “This is where the aftermarket has a huge advantage over the OES channel.If we can get it right, we can steal business away from the OES channel and wecan reduce dwell time and get the driver back on the road. There are somemission-critical benefits the aftermarket can provide fleets and monetize thatopportunity. That’s the future.”

Ben Johnson, director, productmanagement, Mitchell 1, said if the vehicle is transmitting any data, it can goto a fleet management system which can evaluate the data and the fleet managercan run that data through a service that identifies the fault code.

“We know what generally causesthis code and we know the severity of that code so now the first decision is whetherthe truck still safe to drive. Many times, they are [safe to drive] and you candirect them to finish their payload and then we’ll schedule an appointment tohave them in. If that’s not the case, you have to make a decision based on whatthe data is telling you. Is it such a problem that is going to take that truckdown for an extended amount of time? If so, you might want to start logisticallythinking about another tractor to meet this payload to make sure the payloadgets to where it needs to,” Johnson said.

He said there are a number ofgood parts distributors in the heavy-duty industry, but out of the 30-some electronicparts catalog interfaces Mitchell 1 has, very few of them have a robust selectionof heavy-duty parts in them, which means there are phone calls to be made tofind the people who can get the parts.

A more efficient way is to quicklybe able to find those needed parts via analysis of data coming from the vehicleand being able to look into the supply chain to locate the parts. It might bewith a local business or some Midwest distribution center, for example.

“Where does it physically resideso I can figure out the best way to get it onto the vehicle. To me that’s themissing link. We’ve invested a lot in AI and [tools] that analyze repair orders,the history of the vehicle, etc., so we can help predict the future,” Johnson added.

Kar addressed the demand sidefirst.

“Yes, all that information is availablebut is it important to a fleet manager or a warehouse distributor today? Thechallenge in the industry is there’s too much data and too little information.We’re working with the data. The end user only wants mission-criticalinformation that is actionable,” he said. “From a parts warehouse distributorperspective, it is that information that this part is required to be deliveredat a particular shop at this time. If we can make it happen, we can createvalue in the process.”

The two panelists agreed thetime is now for parts distributors and suppliers to invest in this technology.

“If you’re not interested injumping in now, you will probably be selling or going out of business later. Idon’t want to sound that stark but that’s what I believe to be the reality. Fleetsthat are responsible for getting products here to there are going to be countingon parts distribution, service networks, people who can make sure they can helpmeet commitments, and if you’re not one of those on that list, I don’t knowwhat your future holds,” Johnson said.

Kar added, “We’ve been tryingfor the longest time to push this technology but now the time has come wherethe market is pulling it because systems are getting sensorized. The moment youput a sensor in a vehicle system, what ends up happening is that system nowgenerates data. Once that data is available, it will drive decision making. Ifyou do not join this information revolution, you will be left out.”

So, the question becomes how longbefore telematics, data and predictive maintenance come to full fruition forthe heavy-duty industry.

“The predictive maintenance is asgood as the data driving the analysis. You have to structure the data so youcan work with it. There is data coming in from various vehicle systems, componentsand modules, but the data is unstructured, it needs to be scrubbed. Once youhave a massive data ‘lake’ that’s deep and wide, then you can add moreconfidence to the analytics. This change is happening, and I can venture aprediction this will happen in the next five years where every sensorizedvehicle will start offering creative maintenance solutions,” Kar said.

Johnson agreed. “The information is there. Theproblem is they’re all in ponds and not in a great data lake. Until we can getmore of a mass of that information, the better it becomes. But the capabilitiesare here today. It’s just a matter of [cleaning] and outputting thatinformation. It’s a pretty exciting time.”