Cryptocurrency is decentralized digital money that’s based on blockchain technology. You may be familiar with the most popular versions, Bitcoin and Ethereum, but there are more than 5,000 different cryptocurrencies in circulation.

How Does Cryptocurrency Work?

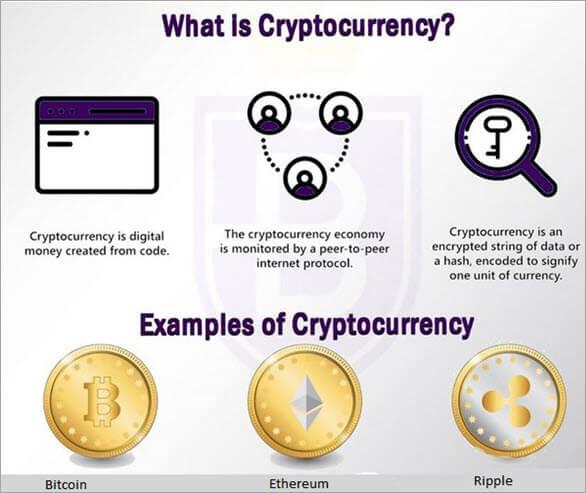

A cryptocurrency is a medium of exchange that is digital, encrypted and decentralized. Unlike the U.S. Dollar or the Euro, there is no central authority that manages and maintains the value of a cryptocurrency. Instead, these tasks are broadly distributed among a cryptocurrency’s users via the internet.

You can use crypto to buy regular goods and services, although most people invest in cryptocurrencies as they would in other assets, like stocks or precious metals. While cryptocurrency is a novel and exciting asset class, purchasing it can be risky as you must take on a fair amount of research to fully understand how each system works.

Best Crypto Exchanges 2022

We've combed through the leading exchange offerings, and reams of data, to determine the best crypto exchanges.

Learn MoreBitcoin was the first cryptocurrency, first outlined in principle by Satoshi Nakamoto in a 2008 paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” Nakamoto described the project as “an electronic payment system based on cryptographic proof instead of trust.”

That cryptographic proof comes in the form of transactions that are verified and recorded on a blockchain.

What Is a Blockchain?

A blockchain is an open, distributed ledger that records transactions in code. In practice, it’s a little like a checkbook that’s distributed across countless computers around the world. Transactions are recorded in “blocks” that are then linked together on a “chain” of previous cryptocurrency transactions.

“Imagine a book where you write down everything you spend money on each day,” says Buchi Okoro, CEO and co-founder of African cryptocurrency exchange Quidax. “Each page is similar to a block, and the entire book, a group of pages, is a blockchain.”

With a blockchain, everyone who uses a cryptocurrency has their own copy of this book to create a unified transaction record. Software logs each new transaction as it happens, and every copy of the blockchain is updated simultaneously with the new information, keeping all records identical and accurate.

To prevent fraud, each transaction is checked using one of two main validation techniques: proof of work or proof of stake.

Proof of Work vs Proof of Stake

Proof of work and proof of stake are two different validation techniques used to verify transactions before they’re added to a blockchain that reward verifiers with more cryptocurrency. Cryptocurrencies typically use either proof of work or proof of stake to verify transactions.

Proof of Work

“Proof of work is a method of verifying transactions on a blockchain in which an algorithm provides a mathematical problem that computers race to solve,” says Simon Oxenham, social media manager at Xcoins.com.

Each participating computer, often referred to as a “miner,” solves a mathematical puzzle that helps verify a group of transactions—referred to as a block—then adds them to the blockchain leger. The first computer to do so successfully is rewarded with a small amount of cryptocurrency for its efforts.

This race to solve blockchain puzzles can require an intense amount of computer power and electricity. In practice, that means the miners might barely break even with the crypto they receive for validating transactions, after considering the costs of power and computing resources.

Proof of Stake

To reduce the amount of power necessary to check transactions, some cryptocurrencies use a proof of stake verification method. With proof of stake, the number of transactions each person can verify is limited by the amount of cryptocurrency they’re willing to “stake,” or temporarily lock up in a communal safe, for the chance to participate in the process. “It’s almost like bank collateral,” says Okoro. Each person who stakes crypto is eligible to verify transactions, but the odds you’ll be chosen to do so increase with the amount you front.

“Because proof of stake removes energy-intensive equation solving, it’s much more efficient than proof of work, allowing for faster verification/confirmation times for transactions,” says Anton Altement, CEO of Osom Finance.

If a stake owner (sometimes called a validator) is chosen to validate a new group of transactions, they’ll be rewarded with cryptocurrency, potentially in the amount of aggregate transaction fees from the block of transactions. To discourage fraud, if you are chosen and verify invalid transactions, you forfeit a part of what you staked.

The Role of Consensus in Crypto

Both proof of stake and proof of work rely on consensus mechanisms to verify transactions. This means while each uses individual users to verify transactions, each verified transaction must be checked and approved by the majority of ledger holders.

For example, a hacker couldn’t alter the blockchain ledger unless they successfully got at least 51% of the ledgers to match their fraudulent version. The amount of resources necessary to do this makes fraud unlikely.

How Can You Mine Cryptocurrency?

Mining is how new units of cryptocurrency are released into the world, generally in exchange for validating transactions. While it’s theoretically possible for the average person to mine cryptocurrency, it’s increasingly difficult in proof of work systems, like Bitcoin.

“As the Bitcoin network grows, it gets more complicated, and more processing power is required,” says Spencer Montgomery, founder of Uinta Crypto Consulting. “The average consumer used to be able to do this, but now it’s just too expensive. There are too many people who have optimized their equipment and technology to outcompete.”

And remember: Proof of work cryptocurrencies require huge amounts of energy to mine. It’s estimated that 0.21% of all of the world’s electricity goes to powering Bitcoin farms. That’s roughly the same amount of power Switzerland uses in a year. It’s estimated most Bitcoin miners end up using 60% to 80% of what they earn from mining to cover electricity costs.

While it’s impractical for the average person to earn crypto by mining in a proof of work system, the proof of stake model requires less in the way of high-powered computing as validators are chosen at random based on the amount they stake. It does, however, require that you already own a cryptocurrency to participate. (If you have no crypto, you have nothing to stake.)

How Can You Use Cryptocurrency?

You can use cryptocurrency to make purchases, but it’s not a form of payment with mainstream acceptance quite yet. A handful of online retailers like Overstock.com accept Bitcoin, but it’s far from the norm.

Until crypto is more widely accepted, you can work around current limitations by exchanging cryptocurrency for gift cards. At eGifter, for instance, you can use Bitcoin to buy gift cards for Dunkin Donuts, Target, Apple and select other retailers and restaurants. You may also be able to load cryptocurrency to a debit card to make purchases. In the U.S., you can sign up for the BitPay card, a debit card that converts crypto assets into dollars for purchase, but there are fees involved to order the card and use it for ATM withdrawals, for example.

You may also use crypto as an alternative investment option outside of stocks and bonds. “The best-known crypto, Bitcoin, is a secure, decentralized currency that has become a store of value like gold,” says David Zeiler, a cryptocurrency expert and associate editor for financial news site Money Morning. “Some people even refer to it as ‘digital gold.’”

How to Use Cryptocurrency for Secure Purchases

Using crypto to securely make purchases depends on what you’re trying to buy. If you’d like to spend cryptocurrency at a retailer that doesn’t accept it directly, you can use a cryptocurrency debit card, like BitPay, in the U.S.

If you’re trying to pay a person or retailer who accepts cryptocurrency, you’ll need a cryptocurrency wallet, which is a software program that interacts with the blockchain and allows users to send and receive cryptocurrency.

To transfer money from your wallet, you can scan the QR code of your recipient or enter their wallet address manually. Some services make this easier by allowing you to enter a phone number or select a contact from your phone. Keep in mind that transactions are not instantaneous as they must be validated using proof of work or proof of stake. Depending on the cryptocurrency, this may take between 10 minutes and two hours.

This lag time, though, is part of what makes crypto transactions secure. “A bad actor trying to alter a transaction won’t have the proper software ‘keys,’ which means the network will reject the transaction. The network also polices and prevents double spending,” Zeiler says.

How to Invest in Cryptocurrency

Cryptocurrency can be purchased on peer-to-peer networks and cryptocurrency exchanges, such as Coinbase and Bitfinex. Keep an eye out for fees, though, as some of these exchanges charge what can be prohibitively high costs on small crypto purchases. Coinbase, for instance, charges a fee of 0.5% of your purchase plus a flat fee of $0.99 to $2.99 depending on the size of your transaction.

Some brokerage platforms—like Robinhood, Webull and eToro—let you invest in crypto. They offer the ability to trade some of the most popular cryptocurrencies, including Bitcoin, Ethereum and Dogecoin, but they may also have limitations, including the inability to move crypto purchases off their platforms.

“It was once fairly difficult but now it’s relatively easy, even for crypto novices,” Zeiler says. “An exchange like Coinbase caters to non-technical folks. It’s very easy to set up an account there and link it to a bank account.”

Featured Partners

1

eToro

Limited Time Offer:Deposit $100 get $10 (US Only)

Fees1%/1%

Cryptocurrencies Available for Trade20+

1

eToro

Learn MoreVia eToro's Website

2

Uphold

Fees (Maker/Taker)0.95%/1.25%

Cryptocurrencies Available for Trade92+

2

Uphold

Learn MoreOn Uphold's Website

3

Crypto.com

Fees (Maker/Taker)0.40%/0.40%

Cryptocurrencies Available for Trade170+

3

Crypto.com

Learn MoreOn Crypto.com's Website

It’s best to keep in mind that buying individual cryptocurrencies is a little like buying individual stocks. Rather than buying only security, its better to spread your purchases out over many different options.

If you want exposure to the crypto market, you might invest in individual stocks of crypto companies. “There are also a few Bitcoin mining stocks such as Hive Blockchain (HIVE),” says Zeiler. “If you want some crypto exposure with less risk, you can invest in big companies that are adopting blockchain technology, such as IBM, Bank of America and Microsoft.”

Should You Invest in Cryptocurrency?

Experts hold mixed opinions about investing in cryptocurrency. Because crypto is a highly speculative investment, with the potential for intense price swings, some financial advisors don’t recommend people invest at all.

For example, Bitcoin nearly quadrupled in value over the course of 2020, closing out the year above $28,900. By April 2021, the price of BTC had more than doubled from where it started the year, but all those gains had been lost by July. Then BTC more than doubled again, hitting an intraday high above $68,990 on November 10, 2021—and then dropped to around $46,000 at the end of 2021. As you can see, cryptocurrencies can be very volatile.

That’s why Peter Palion, a certified financial planner (CFP) in East Norwich, N.Y., thinks it’s safer to stick to currency that’s backed by a government, like the U.S. dollar.

“If you have the U.S. dollar in your cash reserves, you know you can pay your mortgage, you can pay your electricity bill,” Palion says. “When you look at the last 12 months, Bitcoin looks basically like my last EKG, and the U.S. dollar index is more or less a flat line. Something that drops by 50% is not suitable for anything but speculation.”

That said, for clients who are specifically interested in cryptocurrency, CFP Ian Harvey helps them put some money into it. “The weight in a client’s portfolio should be large enough to feel meaningful while not derailing their long-term plan should the investment go to zero,” says Harvey.

As for how much to invest, Harvey talks to investors about what percentage of their portfolio they’re willing to lose if the investment goes south. “It could be 1% to 5%, it could be 10%,” he says. “It depends on how much they have now, and what’s really at stake for them, from a loss perspective.”