All you need to know about blockchain technology and how it enables cryptocurrency transactions and other services.

By Wayne Duggan|May 2, 2022By Wayne Duggan|May 2, 2022, at 5:31 p.m.A blockchain is a digital ledger of transactions that is replicated and distributed across a large network of computer systems, or nodes, to record and secure information.

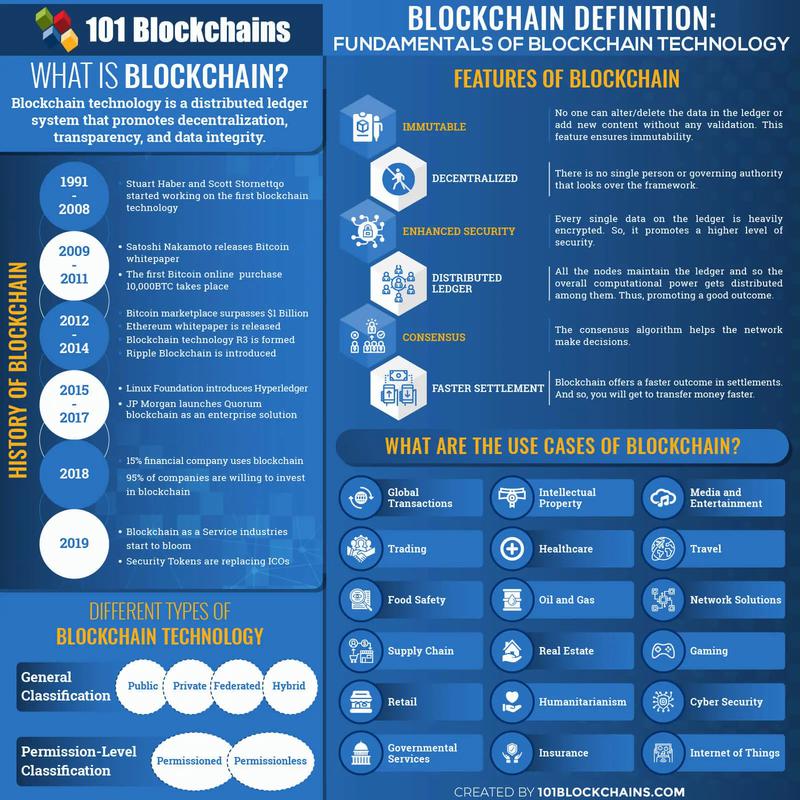

Each block in the blockchain contains a specific number of transactions, and each time a new block is added to the chain, it is added to every network node's ledger. This type of database system utilizes distributed ledger technology. Blockchains are considered decentralized because the data is verified by a majority of the nodes in the network, making all the network participants collectively responsible for security rather than a single central entity.

[Read:

Sign up for stock news with our Invested newsletter. ]Compare Offers

Compare Offers

Ad disclosure

Each party involved in a blockchain transaction has a private key and a public key. These keys are strings of data used to identify a user that function like passwords. By using both private and public keys, each user involved in a blockchain transaction can authenticate themselves via digital signatures.

Once the two parties agree on the transaction, a blockchain network consensus must validate the transaction before it is added to a block in the blockchain. The people who operate the computers that serve as nodes in the blockchains are incentivized to verify transactions via rewards.

Proof of work, or PoW, verification requires so-called miners to use powerful computers to complete complex mathematical functions called hashes. These miners often receive cryptocurrency in return for completing the hashes.

Proof of stake, or PoS, validation is a more energy-efficient process in which transaction validators are selected based on the amount of cryptocurrency they have staked in the blockchain. PoS validation conserves energy because it does not require mining.

Once a block has been validated, it is added to the existing blockchain. The updated ledger is distributed to the entire network, and the transaction is complete.

Blockchain and cryptocurrency are often discussed in tandem. While they are closely related, blockchain and cryptocurrency are two distinct technologies. Cryptocurrency operates on blockchain networks. Bitcoin and other cryptocurrencies were the first use cases for blockchain technology, but there are many other applications for blockchain networks outside of the crypto space.

Cryptocurrencies are also used to fuel blockchain networks, serving as currency for network transactions and rewards for miners and stakers. For example, Ethereum blockchain users pay a transaction fee known as "gas" in Ether, the native Ethereum cryptocurrency. These fees help prevent bad actors from spamming and bogging down the network.

One of the foundational aspects of blockchains is smart contracts, which are programs stored on a blockchain network that run automatically when predetermined conditions are met. Smart contracts can be advantageous to other contracts because they are executed instantaneously and do not require third-party involvement.

Developers can use smart contracts to build and run decentralized applications, or dApps, on blockchain networks. These blockchain networks provide privacy, data integrity and security, and their decentralized nature means developers are not censored or restricted.

Blockchain technology also has a wide range of other uses and applications, including money transfers, financial exchanges, data security, non-fungible tokens, supply chain tracking, gambling and secure voting.

Public blockchain networks are networks in which any person can participate, such as the Bitcoin blockchain. These networks are self-governed, and anyone can read, write and audit activities in a public blockchain network. Private blockchain networks are also decentralized peer-to-peer networks, but private networks have a governing organization that oversees the network. Companies can operate private blockchain networks behind a corporate firewall.

Permissioned blockchain networks are public or private networks that place restrictions on the people allowed to participate in the network and their transactions. Consortium blockchains are similar to private blockchains, but they have multiple entities or organizations overseeing and maintaining the network rather than a single governing entity.

Investors who want to profit off of blockchain technology have several options. First, they can directly purchase cryptocurrencies that run on popular blockchains, such as Bitcoin and Ether. The more people use these blockchains, the more demand there will be for the associated cryptocurrencies and the higher their prices will rise, theoretically.

Investors can also buy a blockchain technology exchange-traded fund, such as the Amplify Transformational Data Sharing ETF (ticker: BLOK) or the Siren Nasdaq NexGen Economy ETF (BLCN).

Finally, investors can also buy shares of stocks that utilize or benefit from blockchain technology, such as cryptocurrency exchange Coinbase Global Inc. (COIN), cryptocurrency mining chipmaker Nvidia Corp. (NVDA) and blockchain technology developer International Business Machines Corp. (IBM).

[See:

What's the Best Cryptocurrency to Buy Now? 7 Contenders. ]In addition to being a potentially lucrative investment opportunity, blockchain technology has several potentially advantageous applications. Blockchain technology can improve transparency within networks, potentially reducing fraud and deception. The technology can be used to create an audit trail that tracks an asset at every step of its journey, protecting against counterfeiting and improving supply chain efficiency.

Blockchain technology can also help improve transaction speed and reduce human error involved in traditional transaction paperwork. Finally, smart contracts can help automate the economy. For example, insurance claims can potentially be instantly settled and paid once a filer provides all the necessary documents.

Blockchain technology can potentially eliminate costly and time-consuming intermediaries from transactions. Blockchain's consensus mechanism for verifying transactions filters out bad data and prevents single bad actors from manipulating existing data. A blockchain network has no single point of failure, so it is extremely resistant to cyberattacks.

Since blockchain is a peer-to-peer system, its decentralized nature empowers its users in a way centralized systems do not. Blockchain users do not need to rely on a bank, government or tech company to allow or complete their transactions. Blockchain networks are also often faster than the traditional financial system, allowing for more transactions in a day than a banking system can accommodate.

While blockchain systems are extremely secure, they are not entirely immune to cyberattacks.

Cryptocurrency exchanges, software platforms that allow users to easily trade various cryptocurrencies, represent a security flaw, as hackers have been able to gain access to users' accounts and steal funds in the past without breaching the actual blockchain. Individual users are subject to phishing attacks, a type of scam in which attackers gain a user's credentials and keys by pretending to be a trusted entity.

Blockchains can be subject to routing attacks in which hackers can intercept data as it is transferred to internet service providers.

Some attackers have successfully used Sybil attacks to bring down blockchain networks. These Sybil attacks involve creating many false network identities and flooding the network. Finally, if a hacker can gain control of at least 51% of the network, they then control the network consensus, as well as the ability to manipulate the ledger.

Way back in 1990, mathematicians Stuart Haber and W. Scott Stornetta first outlined the idea of a verification system using a time-stamped chain of blocks and a hashing system as a way to "fingerprint" a file.

The first true blockchain was created in 2008 when an anonymous person or group using the pseudonym Satoshi Nakamoto published a white paper online describing the Bitcoin blockchain network, including the Bitcoin private key and blockchain ledger. The Bitcoin blockchain was officially launched on Jan. 3, 2009, when the first Bitcoin block was mined.

FAQs

Yes, unless it runs off of renewable energy. As of mid-2022, the computer processing power required for PoW verification consumes a tremendous amount of electricity and has a large carbon footprint.No. While blockchain networks often provide an extremely high degree of security, they are vulnerable to 51% attacks and other breaches.Decentralized finance, of DeFi, refers to the potential shift in the centralized and closed financial system to a more accessible and transparent global economy, a shift which could be enabled by blockchain technology.Related Articles

What to Know About Investment Fees3 Things to Know About Brokerage Margin Accounts7 Best Online Brokerages for Free Trades7 Brokers That Offer Commission-Free Trading