Crypto Bahamas: Insights from the week

The Crypto Bahamas conference recently heard fromindustry and thought leaders alike, former politicians and a starquarterback.

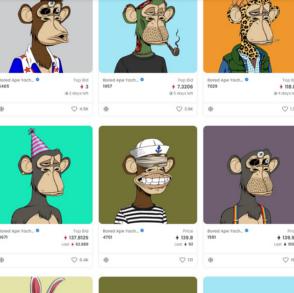

Speakers at the Summit shared insights on pressing issues in theongoing growth of crypto including financial services regulation,tracing of transactions in crypto and of course NFTs.

Below are a few quotes from some of the amazing speaker lineup:

On the topic of the need for regulation to be flexible, Chloe White of Genesis Block said:

like many I didn't see the NFT boom coming. a trap isregulators making rules for [how] things are now, which will[quickly] be[come] outdated. regulators cannot eliminate harm inevery situation, there needs to be an open mindedness andflexibility and a tolerance for some risk.

Executive Director of the Securities Commission of the Bahamas, Christina R. Rolle, also took the opportunityto comment on the requirement for flexible legislation, focusing onthe domestic experience of the Bahamas:

The regulatory journey in the Bahamas was from 2017, [whenthere was] interest from the market looking for a regulatory home.one of the benefits of being a smaller jurisdiction is the abilityto bring policy makers along so they can understand what the marketwants. We learned enough about crypto to help us apply ourregulation sensibly.

Speaking on the need for regulation to be flexible as well asbalanced in serving the interests of consumers, Basil Al Askari of MidChains said:

There's a huge rift arising from lack of uniformregulations in areas, I've had bankers come witness wet-inksignatures in my office. regulations need to avoid being overburdensome and help strike a balance to keep consumers safe andhelping innovation move forward.

Thaigo Cesar took the opportunity to talk uponthe misconception that cryptocurrencies are primarily used forfinancial crime:

In 2015 one congressman tried to ban crypto in Brazilbecause of a worry about Ponzi schemes. The conversation hasshifted now to be more sensible. capital controls remain a key larea of interest. The Senate has passed a crypto licence bill,it's waiting to be signed by the President.

On some of the exciting opportunities that crypto presents to asystem of payments, Constance Wang - the Chief Operating Officerat FTX said:

Travelling the world, it's interesting to see thedifference in developing vs developed countries, I went to Senegalin February, I went to one of the oldest and most prestigious artgalleries. The credit card terminal was broken, but not just there,all over town, the owner said they only take cash or mobile money,he pulled out his phone and I transferred money using a QR code.It's exactly how Blockchain payments works.

P Jillian B. of OKX echoed Wang's sentiments, drawing uponthe example of the Bahamas with respect to Know Your Customer(KYC) requirements:

A useful regulatory example in Bahamas is payment serviceproviders being able to on-board people with no-KYC for payments upto $500. It's a simple thing and helps those who can't passKYC.

Former US Presidential candidate, Andrew Yang, moderated by Kritsin Smith of the Blockchain Association, made the followingcomments on financial inclusion:

When you speak to government about crypto and financialinclusion they say 'show me'. It's important to havereal world examples to show an implementation. The number onequestion I get when I'm walking down the street in New York is'Andrew where's my $1,000!' - I'm working onit!

Speaking on the opportunities of crypto becoming a potentialsector of the S&P in the coming years while drawing upon theCanada example, Kevin O'Leary noted:

The key point for me is when Canada let a Bitcoin backedETF, not a derivative backed ETF but with underlying Bitcoin. Thatshould settle the licensing issue stateside. I personally believecrypto will become the "12th sector" of the S&P inthe next ten years but that can't happen until someoneregulates it.

O'Leary went further to describe a serious banking problemwhich can't arise in the crypto world:

I had a transaction [closing] and the bank lost [the closingpayment of] millions of dollars for 48 hours, jeopardising a dealand sending me and my team out of our minds . and this happens allthe time . I called up a director of the bank and said 'do youknow about USDC?'. If the banks don't get involved instablecoins they will lose business.

On the possibility of a Bitcoin ETF being made available in theUS in the near future, Anthony Scaramucci, former White HouseCommunications Director and SkyBridge Capital founder noted:

The biggest change will be a Bitcoin ETF being available inthe US, everyone is forced into the pool at the same time..Fidelityis going to do what they did in the 1980s to shares and that'sgoing to force more people into the market.

On the opportunity to provide further education to potentialconsumers who seek to adopt crypto, but do not currently have theknowledge to do so, Jeremy Allaire of Circle noted:

For most investors a digital commodity is a really hardconcept to grasp, there isn't a lot of understanding ofBitcoin..The definitions are a real issue because there's nostatute: it's a huge gating issue.

In closing, we repeat the wise words of the Prime Minister ofthe Bahamas, who cautioned those working hard for innovation andsensible regulation which protects participants and supportsinnovation:

remember that change is certain, but progress isnot.